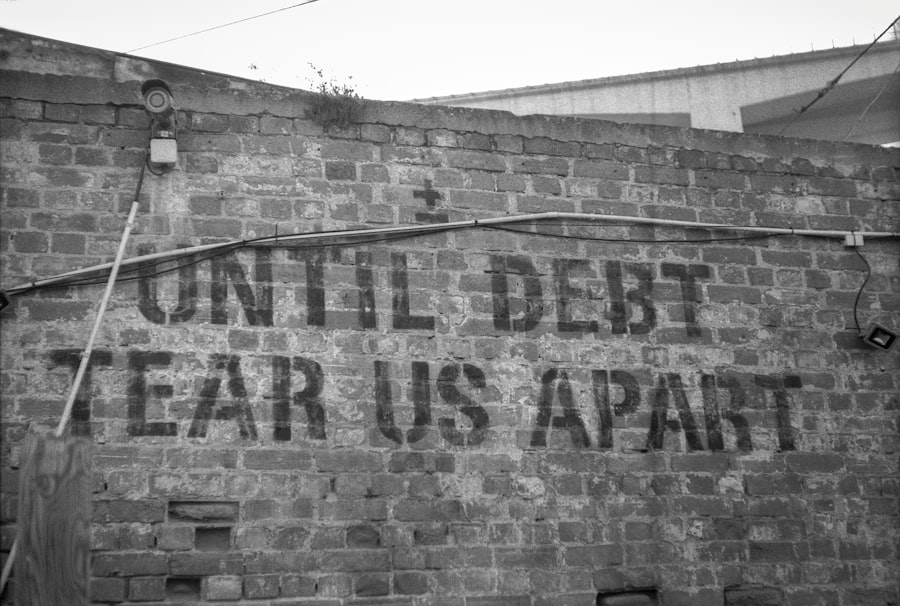

Medical debt has become a leading cause of personal bankruptcy in the United States. Research indicates that a significant percentage of American bankruptcies are directly linked to medical expenses, whether from acute medical emergencies or ongoing treatment for chronic conditions. As healthcare costs have risen substantially over the past decade, patients increasingly struggle to manage their financial obligations alongside their medical needs.

The relationship between medical debt and bankruptcy reflects systemic challenges within the American healthcare system. Unlike many developed nations, the United States does not provide universal healthcare coverage, leaving individuals responsible for substantial out-of-pocket expenses. Even patients with health insurance frequently face high deductibles, copayments, and costs for services not covered by their plans.

When unexpected serious illness or injury occurs, medical bills can quickly accumulate beyond a patient’s ability to pay, forcing individuals and families to choose between medical treatment and financial solvency. Medical debt creates a compounding problem: financial stress from unpaid medical bills can worsen existing health conditions and prevent individuals from seeking preventive care or necessary treatment. This cycle perpetuates both health deterioration and financial instability.

Addressing medical debt bankruptcy requires solutions that tackle rising healthcare costs, improve insurance coverage, and provide relief mechanisms for those already burdened by medical expenses.

Key Takeaways

- Medical debt is a leading cause of bankruptcy, severely affecting individuals and families financially and emotionally.

- High healthcare costs are a primary driver pushing many people into overwhelming debt and bankruptcy.

- Medical debt disproportionately impacts low-income individuals, exacerbating existing economic inequalities.

- Current healthcare system flaws contribute significantly to the rise in medical debt and related bankruptcies.

- Legal reforms, financial literacy, and community support are crucial to preventing and addressing medical debt bankruptcy.

Understanding the Impact of Medical Debt on Individuals and Families

The impact of medical debt on individuals and families can be profound and far-reaching. You may not realize that beyond the immediate financial strain, medical debt can lead to a cascade of negative consequences affecting various aspects of life. For many, the stress of unpaid medical bills can result in sleepless nights, anxiety, and even depression.

The emotional toll can be just as debilitating as the physical ailments that necessitated medical care in the first place. Families often find themselves in a precarious position, where they must make difficult choices about spending on essentials like food and housing versus paying off medical debts. Moreover, the burden of medical debt can strain relationships within families.

You might find that discussions about finances become fraught with tension, leading to conflicts and misunderstandings. The pressure to manage debt can create an environment of fear and uncertainty, where individuals feel isolated in their struggles. This emotional burden can hinder one’s ability to focus on recovery or maintain a healthy lifestyle, further perpetuating the cycle of debt and health issues. You can learn more about managing your health insurance cost by watching this informative video.

The Role of Healthcare Costs in Pushing People into Bankruptcy

Healthcare costs play a pivotal role in pushing individuals and families into bankruptcy. You may be aware that even with insurance coverage, many people face exorbitant out-of-pocket expenses that can quickly accumulate. High deductibles, copayments, and coinsurance can leave patients vulnerable to significant financial strain after receiving care.

For those without insurance, the situation is even more dire, as they may be faced with full bills for treatments that can reach into the tens or hundreds of thousands of dollars. The rising costs of healthcare services are driven by various factors, including administrative expenses, pharmaceutical prices, and the overall complexity of the healthcare system. You might find it alarming that even routine procedures can come with unexpected costs that patients are often unaware of until they receive their bills.

The Link Between Medical Debt and Mental Health

The connection between medical debt and mental health is an area that deserves significant attention. You may not realize how deeply intertwined these two issues are; the stress associated with financial burdens can lead to severe mental health challenges. Individuals grappling with medical debt often experience heightened levels of anxiety and depression, which can further complicate their health conditions.

The constant worry about unpaid bills can create a sense of hopelessness that affects one’s overall well-being. Additionally, the stigma surrounding financial struggles can exacerbate feelings of isolation and shame. You might find that those dealing with medical debt often feel reluctant to seek help or share their experiences due to fear of judgment.

This silence can prevent individuals from accessing necessary support systems or mental health resources, leaving them to navigate their challenges alone. Addressing the mental health implications of medical debt is crucial for fostering resilience and recovery among those affected.

The Disproportionate Impact of Medical Debt on Low-Income Individuals

| Year | Percentage of Bankruptcies Due to Medical Debt | Average Medical Debt Amount | Total Number of Medical Debt Bankruptcies | Percentage of Total Bankruptcies |

|---|---|---|---|---|

| 2010 | 62% | 15,000 | 350,000 | 55% |

| 2015 | 53% | 18,500 | 300,000 | 48% |

| 2020 | 42% | 22,000 | 250,000 | 40% |

| 2023 | 38% | 25,000 | 220,000 | 35% |

Low-income individuals bear a disproportionate burden when it comes to medical debt. You may be aware that those with limited financial resources often lack access to quality healthcare services, leading to delayed treatments and worsening health conditions. When they do seek care, they may face higher out-of-pocket costs relative to their income, making it even more challenging to manage medical expenses.

This inequity creates a cycle where low-income individuals are more likely to incur significant medical debt and subsequently face bankruptcy. Moreover, the lack of financial safety nets for low-income families exacerbates this issue. You might find it troubling that many low-income individuals do not have savings or assets to fall back on when faced with unexpected medical expenses.

This vulnerability leaves them with few options other than accruing debt or declaring bankruptcy. The systemic barriers that contribute to this disparity highlight the urgent need for reforms aimed at ensuring equitable access to healthcare for all individuals, regardless of their economic status.

The Flaws in the Current Healthcare System Contributing to Medical Debt Bankruptcy

The current healthcare system is riddled with flaws that contribute significantly to the rise of medical debt bankruptcy. You may have noticed how complex billing practices and a lack of transparency create confusion for patients trying to navigate their healthcare options. Many individuals are unaware of the costs associated with procedures until after they have received care, leaving them vulnerable to unexpected financial burdens.

This opacity in pricing not only breeds distrust but also makes it nearly impossible for patients to make informed decisions about their healthcare. Additionally, the fragmented nature of the healthcare system often leads to inefficiencies and increased costs. You might find it frustrating that patients frequently receive bills from multiple providers for a single treatment episode, each with its own set of charges.

This disjointed approach complicates billing processes and can result in patients being overwhelmed by multiple debts at once. Addressing these systemic flaws is essential for creating a more equitable healthcare landscape that prioritizes patient well-being over profit.

Legal and Policy Solutions to Address the Rise of Medical Debt Bankruptcy

To combat the rise of medical debt bankruptcy, legal and policy solutions must be implemented at both state and federal levels.

These measures include capping interest rates on medical debt and providing clearer guidelines for billing practices.

Such initiatives are crucial for ensuring that patients are treated fairly and are not subjected to predatory practices during their most vulnerable moments. On a broader scale, comprehensive healthcare reform is necessary to address the root causes of high medical costs. You might advocate for policies that promote universal coverage or expand access to affordable insurance options.

By reducing the financial burden associated with healthcare, these reforms could significantly decrease the number of individuals facing bankruptcy due to medical debt. Additionally, increasing funding for community health programs can help ensure that low-income individuals receive preventive care, ultimately reducing their reliance on expensive emergency services.

The Importance of Financial Literacy and Healthcare Planning in Preventing Medical Debt Bankruptcy

Financial literacy plays a critical role in preventing medical debt bankruptcy. You may not realize how understanding personal finance can empower individuals to make informed decisions about their healthcare options. By educating yourself about insurance plans, out-of-pocket costs, and available resources, you can better navigate the complexities of the healthcare system.

This knowledge can help you avoid unexpected expenses and make choices that align with your financial situation. Healthcare planning is equally important in mitigating the risk of incurring significant medical debt. You might consider developing a proactive approach by researching potential healthcare providers and understanding their billing practices before seeking care.

Additionally, creating a budget that accounts for potential medical expenses can provide a safety net during times of need. By prioritizing financial literacy and planning, you can take control of your healthcare journey and reduce your vulnerability to medical debt.

The Stigma and Shame Surrounding Medical Debt Bankruptcy

The stigma surrounding medical debt bankruptcy is a pervasive issue that affects many individuals’ willingness to seek help or share their experiences. You may have noticed how society often views bankruptcy as a personal failure rather than a consequence of systemic issues within the healthcare system. This perception can lead to feelings of shame and isolation among those struggling with medical debt, preventing them from accessing necessary support networks.

Breaking down this stigma requires open conversations about the realities of medical debt and its impact on people’s lives. You might find it helpful to engage in discussions that normalize these experiences and highlight the fact that many individuals face similar challenges due to circumstances beyond their control. By fostering an environment where people feel safe sharing their stories, we can begin to dismantle the shame associated with medical debt bankruptcy and encourage collective action toward meaningful change.

The Need for Community Support and Resources for Individuals Struggling with Medical Debt

Community support plays a vital role in helping individuals navigate the challenges associated with medical debt. You may be surprised by how many local organizations offer resources such as financial counseling, legal assistance, or support groups for those facing similar struggles. These resources can provide invaluable guidance and encouragement during difficult times, helping individuals regain control over their financial situations.

Additionally, fostering a sense of community can help combat feelings of isolation often experienced by those dealing with medical debt. You might consider participating in local advocacy efforts aimed at raising awareness about this issue or connecting with others who share similar experiences. By building supportive networks within your community, you can create an environment where individuals feel empowered to seek help and work toward solutions together.

Personal Stories of Individuals Affected by Medical Debt Bankruptcy

Personal stories illuminate the harsh realities faced by those affected by medical debt bankruptcy. You may have heard accounts from individuals who have experienced firsthand the devastating impact of overwhelming bills after a serious illness or accident. One such story involves a single mother who found herself unable to pay her child’s hospital bills after an unexpected emergency surgery.

Despite her best efforts to manage her finances, she ultimately had no choice but to declare bankruptcy—a decision that left her feeling defeated and hopeless. Another poignant example is that of an elderly couple who had worked hard all their lives but found themselves facing insurmountable medical expenses due to chronic health conditions. They had always prided themselves on being financially responsible but were unprepared for the reality of high healthcare costs.

Their story serves as a reminder that anyone can fall victim to the pitfalls of our current healthcare system, regardless of their background or financial acumen. These personal narratives highlight the urgent need for systemic change in how we approach healthcare costs and support those affected by medical debt bankruptcy. By sharing these stories, you contribute to raising awareness about this critical issue and advocating for solutions that prioritize patient well-being over profit margins.

Medical debt is a significant issue for many Americans, often leading to financial distress and even bankruptcy. According to recent statistics, a substantial portion of bankruptcies in the U.S. can be attributed to medical expenses. For a deeper understanding of the impact of medical debt on financial stability, you can read more in this related article on medical debt bankruptcy statistics at How Wealth Grows.

WATCH THIS! WATCH THIS! 💊 Health Insurance Is The Next Housing Bubble (And It Will Bankrupt You)

FAQs

What is medical debt bankruptcy?

Medical debt bankruptcy refers to the filing for bankruptcy primarily due to overwhelming medical expenses that an individual or family cannot pay.

How common is bankruptcy due to medical debt?

Studies have shown that medical debt is a leading cause of personal bankruptcy in many countries, with a significant percentage of bankruptcy filers citing medical bills as a major factor.

What percentage of bankruptcies are related to medical debt?

Research varies by region, but in the United States, for example, medical debt is estimated to be a contributing factor in approximately 40% to 60% of personal bankruptcies.

Who is most affected by medical debt bankruptcy?

Individuals without adequate health insurance, those with chronic illnesses, and families facing unexpected medical emergencies are most vulnerable to medical debt bankruptcy.

How does medical debt lead to bankruptcy?

High medical bills can accumulate quickly, especially after hospital stays, surgeries, or long-term treatments. When these debts exceed a person’s ability to pay, they may resort to bankruptcy to manage or discharge the debt.

Are there differences in medical debt bankruptcy rates by demographics?

Yes, factors such as income level, insurance coverage, age, and geographic location can influence the likelihood of medical debt leading to bankruptcy.

What impact does medical debt bankruptcy have on individuals?

Filing for bankruptcy due to medical debt can affect credit scores, limit access to future credit, and cause emotional and financial stress, but it can also provide relief from unmanageable debt.

Can medical debt bankruptcy be prevented?

Preventative measures include having comprehensive health insurance, seeking financial assistance programs, negotiating medical bills, and using payment plans offered by healthcare providers.

How do medical debt bankruptcy statistics help policymakers?

These statistics inform healthcare and financial policy decisions aimed at reducing the burden of medical debt and improving access to affordable healthcare.

Where can I find reliable medical debt bankruptcy statistics?

Reliable data can be found through government health agencies, financial research organizations, academic studies, and nonprofit groups focused on healthcare and consumer finance.