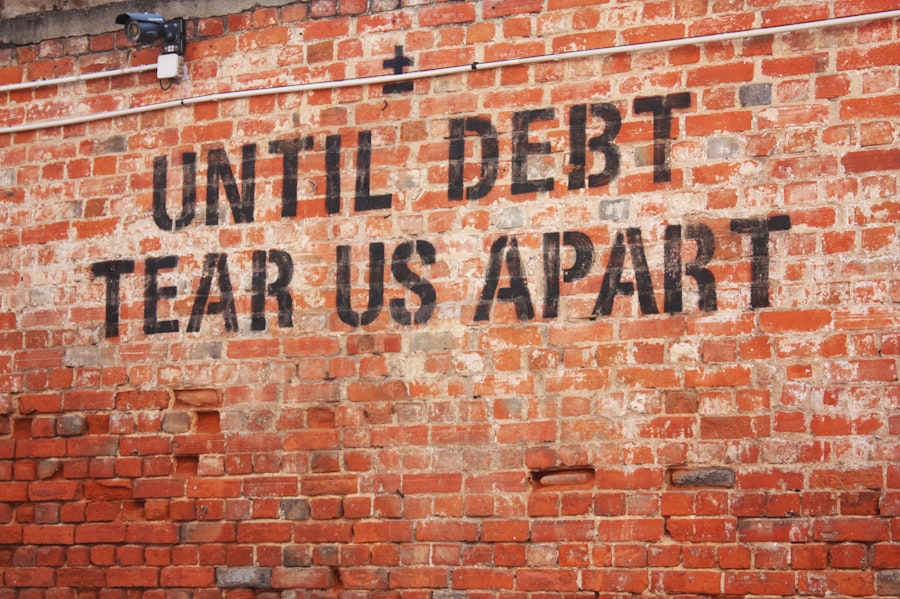

You stand at a crossroads, a generation poised to build families, yet held back by the chains of student debt. The dream of parenthood, once a natural progression, has become a precarious mountain to climb for many in your cohort, the Gen Z. The pervasive specter of student loan debt is not merely a financial inconvenience; it’s a genuine barrier, a cold hand on the tiller steering you away from the shores of family life. This is the reality of the student debt crisis, and its profound impact on your aspirations for parenthood.

You entered adulthood with the promise of higher education as a pathway to opportunity. For many, this promise came with a hefty price tag, a debt that has ballooned into a significant economic burden. This debt is not a fleeting expense; it’s a long-term commitment, a silent partner in your financial life that dictates future decisions.

The Scale of the Problem

The numbers are stark. You are graduating into a world where student loan debt has reached astronomical figures. Millions of your peers are burdened by sums that can rival a down payment on a house or even the cost of raising a child for their first few years. This debt is a national crisis, a systemic issue with far-reaching consequences, and you are at its forefront.

Repayment Looms Large

The reality of repayment is a constant hum in the background of your financial planning. Interest accrues, turning what might have seemed like a manageable loan at the outset into a much larger sum over time. This financial obligation dictates your spending habits, your career choices, and ultimately, your ability to take on the significant financial responsibilities of parenthood.

The Psychological Toll

Beyond the purely financial, the psychological weight of student debt is immense. It fosters anxiety, limits your sense of financial freedom, and can lead to feelings of being trapped. This emotional burden can further dampen the desire or perceived feasibility of starting a family.

The financial challenges faced by Gen Z, particularly in relation to student debt, have sparked widespread discussion about their ability to start families. A related article that delves deeper into the economic pressures on this generation can be found at How Wealth Grows, which explores the implications of rising living costs and educational expenses on family planning. This resource provides valuable insights into the broader context of financial stability and its impact on the decisions of young adults today.

Financial Foundations: A Crumbling Blueprint for Parenthood

The traditional path to parenthood often involves establishing a stable financial foundation. This includes having savings for emergencies, the ability to afford childcare, and the security of a comfortable living situation. For you, laden with student debt, these foundations feel less like solid ground and more like shaky scaffolding.

The Savings Drought

Saving for a down payment on a home, a necessity for many parents, becomes an almost insurmountable task when a substantial portion of your income is diverted to student loan payments. The dream of a stable home, a nursery, and ample space for a growing family recedes further with each monthly loan installment.

The Childcare Conundrum

Childcare costs are notoriously high, often eclipsing mortgage payments or rent. When faced with the choice between servicing your student debt and affording quality childcare, the decision becomes agonizing. The financial squeeze makes the prospect of adding another person to your household a terrifying financial proposition.

The Housing Hurdle

The housing market, already challenging, becomes an even greater obstacle when grappling with student debt. Lenders are often hesitant to approve mortgages for individuals with significant outstanding loan obligations. This means you might be stuck renting for longer, a less stable and often more expensive option for families.

Career Choices Under Duress

The pressure to earn enough to manage your student debt can significantly influence your career trajectory. This can lead to choices that, while financially expedient in the short term, might not align with your personal aspirations or the long-term needs of a family.

The “Golden Handcuffs” of High-Earning Industries

You might feel compelled to pursue careers in high-earning fields, even if they are not your passion. This can lead to demanding work schedules, extensive travel, and less flexibility – all of which are detrimental to the demands of early parenthood. The allure of a large paycheck to conquer debt can feel like a trap, binding you to a life that may not allow for the nurturing presence you envision for your children.

The Sacrifice of Passion for Profit

The pursuit of a lower-paying but more fulfilling career, one that might offer better work-life balance and more time for family, becomes a distant dream. The immediate need to repay debt overshadows the potential for long-term happiness and family well-being. You are forced to weigh the intangible benefits of a passion-driven career against the tangible burden of debt.

The Impact on Entrepreneurship

The entrepreneurial spirit, a hallmark of your generation, can also be stifled by student debt. Starting a business often requires significant upfront investment and a period of lower income. The existence of student loan payments makes this risk even more daunting, potentially delaying or even preventing the launch of innovative ventures that could have shaped the future.

Delaying or forgoing Parenthood: A Growing Trend

The confluence of financial burdens and career constraints is leading to a tangible shift in your generation’s approach to parenthood. What was once a common life stage is increasingly being postponed or, for some, entirely reevaluated.

The “Launching Pad” for Parenthood is Unstable

You are essentially being asked to build a family on shifting sands. The traditional “launching pad” – a stable financial and personal life – is eroded by the persistent demands of student loan repayment. This instability makes taking on the immense responsibility of raising children feel like a leap of faith into the unknown.

The “When” Becomes “If”

For many, the question has shifted from “When will I have children?” to “Will I ever be able to afford to have children?” This is a heartbreaking reframe of a fundamental life aspiration, driven by the practical realities of your economic situation. The dream doesn’t disappear, but the perceived pathway to its realization becomes increasingly obscured.

The Broader Societal Implications

This trend has significant societal implications, including potential demographic shifts and a strain on social security systems in the future. Your generation’s delayed or forgone parenthood is not just a personal struggle; it’s a collective challenge with long-term consequences for society as a whole.

The financial challenges faced by Gen Z are increasingly evident, particularly when it comes to the decision to start families. A significant factor contributing to this dilemma is the burden of student debt, which often leaves young adults with limited disposable income. For a deeper understanding of how these economic pressures impact the younger generation’s financial decisions, you can read more in this insightful article on wealth management. It explores various aspects of financial literacy and planning that are crucial for navigating today’s economic landscape. To learn more, visit this article.

Solutions and Support: Lighting the Path Forward

| Metric | Value | Impact on Gen Z’s Ability to Have Kids |

|---|---|---|

| Average Student Debt per Graduate | 30,000 | High monthly payments reduce disposable income for child-rearing expenses |

| Percentage of Gen Z with Student Debt | 65% | Majority face financial constraints delaying family planning |

| Average Monthly Student Loan Payment | 350 | Limits ability to save for childcare, education, and housing |

| Median Age of First-Time Parents (Gen Z) | 30 years | Delayed parenthood linked to financial instability from debt |

| Percentage of Gen Z Reporting Student Debt as a Barrier to Having Kids | 45% | Significant portion cite debt as a direct reason to postpone or avoid children |

| Average Cost of Raising a Child to Age 18 | 250,000 | High costs compounded by existing debt discourage family expansion |

Addressing the student debt crisis as a barrier to parenthood requires a multi-faceted approach. It involves individual strategies, but more importantly, systemic changes and robust support systems.

Debt Relief and Reform

- Federal Loan Forgiveness Programs: Exploring and expanding existing or implementing new federal loan forgiveness programs, particularly for public service or low-income borrowers, could significantly alleviate the burden.

- Interest Rate Caps and Refinancing Options: Capping interest rates on student loans and creating more accessible and favorable refinancing options would reduce the overall cost of borrowing.

- Income-Driven Repayment Plans: Ensuring that income-driven repayment plans are widely understood, accessible, and truly affordable can provide a safety net.

Financial Literacy and Planning

- Early Financial Education: Integrating comprehensive financial literacy into high school and college curricula can equip you with the knowledge to navigate student loans and plan for future financial goals, including parenthood.

- Affordable Financial Counseling: Providing access to affordable and unbiased financial counseling services can help individuals create personalized plans to manage debt and save for family-related expenses.

Parental Support Systems

- Affordable Childcare Initiatives: Government subsidies, tax credits, and employer-sponsored childcare programs are crucial in making parenthood financially viable.

- Paid Family Leave Policies: Implementing robust paid family leave policies allows parents to bond with their newborns and recover without the immense financial strain of lost income.

- Housing Assistance Programs: Expanding access to affordable housing initiatives and rental assistance programs can help alleviate the housing hurdle for prospective and new parents.

Shifting Societal Narratives

- Valuing Parenthood: Fostering societal conversations that acknowledge and value the immense contribution of raising children, and recognizing the financial challenges involved, is essential.

- Empathy and Understanding: Encouraging empathy and understanding from older generations and policymakers regarding the unique financial challenges faced by Gen Z is crucial for driving meaningful change.

You are a generation facing unprecedented economic challenges, and the dream of parenthood should not be a casualty of a flawed system. By understanding the scope of the problem, advocating for necessary reforms, and supporting one another, you can begin to dismantle the barriers and build a future where your aspirations for family life are not overshadowed by the weight of debt. The path forward requires collective action and a commitment to ensuring that the next generation of parents has the opportunity to thrive, not just survive.

FAQs

1. Why is student debt a significant issue for Gen Z?

Student debt is a significant issue for Gen Z because many individuals in this generation have taken on substantial loans to finance their higher education. This debt often results in long-term financial burdens, affecting their ability to save, invest, or make major life decisions such as starting a family.

2. How does student debt impact Gen Z’s decision to have children?

Student debt impacts Gen Z’s decision to have children by limiting their financial resources. The high monthly loan repayments reduce disposable income, making it challenging to afford the costs associated with raising children, including healthcare, childcare, education, and housing.

3. What are the average student loan amounts for Gen Z borrowers?

The average student loan amount for Gen Z borrowers varies by country and institution but generally ranges from $20,000 to over $40,000. These amounts can accumulate with interest, increasing the total repayment burden over time.

4. Are there any programs or policies aimed at alleviating student debt for Gen Z?

Yes, some governments and organizations offer student loan forgiveness programs, income-driven repayment plans, and grants to help alleviate student debt. However, the availability and effectiveness of these programs vary widely and may not fully address the financial challenges faced by Gen Z.

5. How does student debt affect other financial goals for Gen Z besides having children?

Besides impacting the decision to have children, student debt can delay other financial goals for Gen Z, such as buying a home, saving for retirement, or starting a business. The burden of loan repayments often forces individuals to prioritize debt repayment over other investments and expenditures.