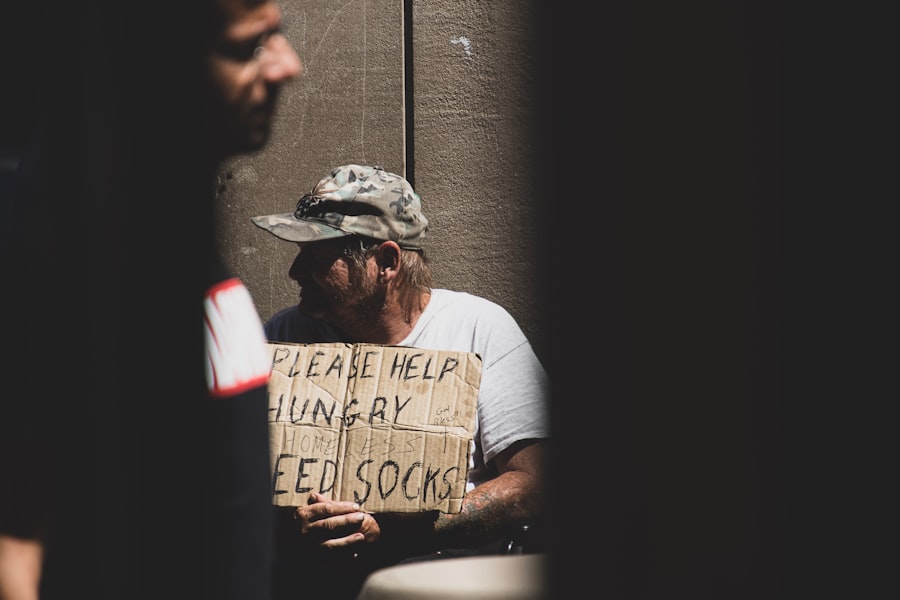

You’ve likely seen them, the stark silhouettes against the urban glow, the crumpled blankets, the cardboard signs. Homelessness in our cities is a pervasive, painful issue. You might have wondered, as you navigate your daily commute, how we arrived at such a stark societal divide. While the roots of homelessness are complex and multi-layered, a growing body of evidence points to a significant, often overlooked, contributor: the influence of private equity. You might be surprised to learn that the very firms that manage vast sums of capital, aiming for aggressive returns, can, in their pursuit of profit, cast long shadows that engulf those already on the margins. This is not about assigning blame to every investor or every firm; rather, it’s about understanding a powerful financial mechanism and its tangible, deeply human consequences.

Private equity firms are akin to sophisticated financial architects, but instead of buildings, they construct wealth through acquiring and managing companies. They pool capital from institutional investors – pension funds, university endowments, sovereign wealth funds – and use this money to buy stakes, or entire companies, that are not publicly traded. Their playbook typically involves improving the operational efficiency and profitability of these acquired businesses, often with the intention of selling them for a profit within a few years. This aggressive, results-driven approach, while capable of generating substantial returns for investors, can also have a ripple effect that extends far beyond the boardroom.

What Exactly is Private Equity?

You might picture private equity as a mysterious, exclusive club. At its core, it is an alternative asset class that invests in businesses that are privately held, meaning their shares are not available for purchase on public stock exchanges like the NYSE or NASDAQ. These firms operate with a specific investment horizon, usually between three to seven years, during which they aim to maximize the value of their portfolio companies. This is achieved through various strategies, often involving significant operational changes, cost-cutting measures, and debt financing.

The Investment Cycle: Acquisition, Improvement, and Exit

The lifecycle of a private equity investment follows a predictable pattern. First, the firm identifies a target company, meticulously analyzing its financial health and potential for growth. Once acquired, often using a significant amount of borrowed money (a strategy known as a leveraged buyout or LBO), the firm’s management team swoops in. They implement their strategies to “optimize” the business. This can involve anything from streamlining supply chains and consolidating operations to laying off workers and divesting non-core assets. The ultimate goal is to enhance the company’s profitability and market value before selling it off, ideally at a considerable markup, a process known as an “exit.”

Leverage: The Double-Edged Sword of Debt

A hallmark of private equity deals is the extensive use of leverage. This means borrowing a substantial amount of money to finance the acquisition. While leverage can amplify returns when a company performs well, it also significantly increases risk. The acquired company is burdened with substantial debt payments, effectively becoming a debtor to the private equity firm itself. This debt servicing often becomes the primary focus, sometimes at the expense of critical investments in the company’s long-term health or its workforce.

The relationship between private equity and homelessness has become a pressing issue in recent years, as investment firms increasingly acquire affordable housing properties, often leading to rent hikes and displacement of vulnerable populations. For a deeper understanding of this complex dynamic, you can explore the article available at How Wealth Grows, which discusses the impact of financial investments on housing stability and the broader implications for communities facing homelessness.

The Housing Market: A Prime Target for Private Equity’s Gaze

The housing market, with its consistent demand and potential for long-term appreciation, has become an increasingly attractive arena for private equity firms. They are not just buying single-family homes as speculative investments; they are increasingly acquiring entire portfolios of rental properties, from apartment complexes to individual houses. This shift has profound implications for housing affordability and the stability of rental markets, directly impacting your neighbors and communities.

The Influx of Institutional Landlords: A New Era of Renting

You’ve seen the signs, perhaps. The once locally-owned apartment building is now managed by a large, faceless corporation. This is often the handiwork of private equity. These firms are buying up vast quantities of residential real estate, transforming them into rental portfolios. They treat housing not just as a place for people to live, but as a financial asset to be managed for maximum return, much like a stock or a bond.

From Mom-and-Pop to Mega-Landlord: The Shifting Landscape of Property Ownership

Historically, the rental housing market was characterized by a multitude of small-scale landlords. These individuals often had a personal connection to their properties and tenants. The rise of private equity has drastically altered this dynamic. Large, often publicly-traded, entities backed by private equity now control significant portions of the rental housing stock. While they may argue for economies of scale and professional management, the reality on the ground for tenants can be starkly different.

The Commodification of Shelter: Housing as an Investment Vehicle

When housing is viewed primarily as an investment vehicle, the human element can become secondary. Private equity’s focus on financial metrics can lead to decisions that prioritize profitability over tenant well-being or long-term community stability. This commodification of shelter means that the fundamental need for a safe and stable place to live can be subject to the whims of financial markets and investor demands.

Strategies for Maximizing Returns: What It Means for Renters

Once a private equity firm acquires a portfolio of rental properties, their strategies for profit maximization can directly impact renters. This often involves increasing rents, reducing maintenance and services, and employing aggressive eviction tactics to remove tenants who are late on payments. These actions can create a cascade of instability for individuals and families already struggling to make ends meet.

Rent Increases: A Relentless Climb

You’ve likely seen the headlines about soaring rents. Private equity-backed landlords have been found to implement more frequent and significant rent hikes compared to smaller landlords. This is often a strategy to quickly recoup acquisition costs and generate immediate returns. For tenants, this can mean being priced out of their homes, forcing them to find new, potentially more expensive, housing in an already tight market.

Deferred Maintenance and Declining Services: The True Cost of Cost-Cutting

To boost profit margins, private equity firms might slash budgets for property maintenance and repairs. This can lead to deteriorating living conditions, with leaky roofs, broken appliances, and inadequate heating becoming commonplace. The tenant experience can shift from living in a home to residing in a property that is managed with a bare-minimum approach, prioritizing cost savings above all else.

Eviction Machines: Aggressive Tactics to Assert Control

In their pursuit of market-rate rents, private equity firms may employ aggressive eviction tactics. Tenants who fall even slightly behind on rent can face eviction proceedings, often with little recourse. This creates a climate of fear and instability, disproportionately affecting low-income renters and making it harder for them to maintain stable housing.

The Link to Homelessness: Breaking the Chain of Causality

The connection between private equity’s activities in the housing market and the rise in homelessness might not be immediately obvious, but it is a tangible and critical one. When rents become unaffordable, when stable housing is stripped of its fundamental security, the most vulnerable members of society are pushed to the brink.

The Erosion of Affordability: The First Domino

The most direct link lies in the erosion of housing affordability. As private equity firms drive up rents in apartment complexes and single-family homes, more individuals and families find themselves unable to secure or maintain stable housing. This is particularly acute for those on fixed incomes or in low-wage jobs, who are often the first to be priced out of the market.

The “Rent Burden”: When Housing Consumes Too Much Income

A critical threshold in housing affordability is the “rent burden” – when a household spends more than 30% of its income on housing. Private equity’s strategies often push more households across this threshold. When a significant portion of income is dedicated to rent, there is little left for other essential needs like food, healthcare, or transportation, let alone savings for unexpected emergencies. This precarious financial situation makes individuals highly vulnerable to falling into homelessness.

The Vanishing Middle Ground: The Squeeze on Affordable Units

Private equity’s focus on maximizing returns often leads to the conversion of naturally affordable units into higher-rent properties or their acquisition and repositioning at market rates. This effectively shrinks the supply of housing that is within reach for low- and moderate-income individuals, leaving them with fewer options and increasing competition for the remaining affordable units.

Eviction as a Pathway to the Streets: The Final Precipice

When affordability erodes and individuals are unable to meet escalating rent demands, eviction becomes a common outcome. An eviction record is a scarlet letter, making it incredibly difficult to secure new housing. For those who have been evicted, and especially for those who lack savings or a support network, the streets can become their only option. This is the direct pathway from a stable, albeit unaffordable, home to homelessness.

The “No-Cause” Eviction: A Tool of Displacement

In many jurisdictions, private equity landlords can utilize “no-cause” evictions, allowing them to remove tenants without specific reasons, especially at the end of a lease term. This power, wielded by large, impersonal entities, can lead to mass displacement and further exacerbate housing instability for entire communities.

The Cycle of Displacement: From One Neighborhood to the Next

For those forced out of their homes, the search for new housing can be a desperate scramble. They may be pushed from one neighborhood to another, often ending up in areas with fewer resources and support services. This constant displacement can sever ties to community, employment, and social networks, making it even harder to escape the cycle of housing insecurity.

Case Studies and Data: Illuminating the Pattern

While the mechanisms are complex, the evidence linking private equity to housing instability and homelessness is growing. You don’t have to take our word for it; data and real-world examples paint a stark picture.

The Rise of Institutional Ownership of Single-Family Homes

Numerous reports and academic studies have documented the significant increase in private equity ownership of single-family homes, particularly in the wake of the 2008 financial crisis. These firms acquired vast numbers of foreclosed properties, converting them into rental units.

Post-2008 Acquisitions: A Flood of Investor-Owned Properties

Following the foreclosure crisis, private equity firms strategically purchased distressed single-family homes at low prices. This acquisition spree fundamentally altered the landscape of homeownership, turning these properties into rental assets managed for profit. You might have noticed a change in your neighborhood during this period, with the gradual disappearance of owner-occupied homes replaced by rental properties managed by large corporations.

Impact on Local Housing Markets: Price Hikes and Availability

The influx of institutional buyers has been linked to rising home prices and reduced availability of homes for purchase, particularly for first-time homebuyers. This competition drives up costs, making it harder for individuals to achieve homeownership and increasing reliance on the rental market.

Research on Rent Increases and Eviction Rates

Academic research and reports from housing advocacy groups have increasingly focused on the correlation between private equity ownership and negative outcomes for renters.

Studies Demonstrating Higher Rent Growth in PE-Owned Properties

Various studies have shown that properties owned by private equity firms tend to experience higher rent growth and more frequent rent increases compared to those owned by smaller landlords. These increases are often attributed to aggressive revenue management strategies.

Eviction Data and Corporate Landlord Patterns

Data analysis has also revealed patterns of higher eviction rates in portfolios managed by large, private equity-backed landlords. These firms may have more streamlined, and often more aggressive, eviction processes in place.

The growing concern over the impact of private equity on various sectors has led to discussions about its connection to homelessness. A recent article explores how investments in housing and real estate by private equity firms can inadvertently contribute to rising rents and displacement of low-income families. This complex relationship highlights the need for a deeper understanding of the implications of financial practices on vulnerable populations. For more insights on this topic, you can read the article here.

Broader Societal Implications and Potential Solutions

| Metric | Value | Source/Notes |

|---|---|---|

| Percentage of rental housing owned by private equity firms | 10-15% | Estimated in major US cities (2023 studies) |

| Increase in average rent in private equity-owned properties (annual) | 8-12% | Compared to 3-5% in non-private equity properties |

| Eviction rate in private equity-owned rental units | 2-3 times higher | Relative to local average eviction rates |

| Correlation between private equity rental ownership and local homelessness rate | Positive correlation (r = 0.45) | Based on urban housing market analyses |

| Number of homeless individuals in cities with high private equity rental ownership | Up to 25% higher | Compared to cities with low private equity presence |

| Percentage of private equity firms investing in affordable housing | Less than 5% | Industry reports 2023 |

The impact of private equity on housing extends beyond individual crises. It can contribute to broader societal issues of inequality and economic instability. Recognizing this connection is the first step toward seeking solutions.

The Widening Wealth Gap: The Rich Get Richer, the Vulnerable Fall Behind

The success of private equity, while benefiting some investors, can exacerbate existing wealth disparities. When housing, a fundamental necessity, becomes a primary driver of this wealth accumulation for a select few, it leaves many others struggling to keep pace, widening the gap between the haves and have-nots.

The Concentration of Wealth: A Few Benefiting Immensely

The aggressive pursuit of returns by private equity firms can lead to significant wealth concentration. A small number of investors and firm principals benefit immensely, while the broader population may experience declining economic security.

The Erosion of the Middle Class: A Squeezed Existence

As housing costs rise and job security diminishes, the middle class can find itself increasingly squeezed. The dream of financial stability becomes more elusive, and the risk of falling into poverty or homelessness increases.

Policy Interventions and Community Action: Reclaiming Housing

Addressing the influence of private equity on housing requires a multi-pronged approach, involving policy changes and concerted community efforts.

Tenant Protections and Rent Stabilization Measures

Implementing stronger tenant protections, such as rent stabilization policies and limits on no-cause evictions, can help curb excessive rent increases and provide greater housing security for vulnerable populations.

Increased Investment in Affordable Housing

A robust strategy must include significant public investment in the creation and preservation of affordable housing units. This can provide a vital safety net and counterbalance the market-driven pressures of private equity.

Holding Private Equity Accountable: Transparency and Regulation

Greater transparency and regulation of private equity firms’ activities in the housing market are crucial. This could involve requiring more disclosure of ownership structures, limiting debt levels in leveraged buyouts, and ensuring that these firms are held accountable for the impact of their investments on communities.

Community Land Trusts and Non-Profit Housing Development

Support for community land trusts and non-profit housing developers can offer alternative models of housing ownership and management that prioritize affordability and community well-being over profit maximization.

You might feel a sense of unease, a recognition of a force at play that you hadn’t fully grasped. The link between private equity and homelessness is not a simple cause-and-effect, but rather a complex interplay of financial strategies and human needs. By understanding these dynamics, you are empowered to advocate for policies and support initiatives that ensure housing remains a right, not just a commodity, for all members of our society.

▶️ WARNING: How Private Equity Is Liquidating Your Home Equity

FAQs

What is private equity?

Private equity refers to investment funds that buy and restructure companies that are not publicly traded. These funds typically invest in businesses with the goal of improving their value and eventually selling them for a profit.

How can private equity impact housing markets?

Private equity firms often invest in real estate, including residential properties. Their involvement can lead to increased property prices and rents, as they seek to maximize returns, which may reduce affordable housing availability.

What is the connection between private equity and homelessness?

Some studies suggest that private equity investments in rental housing can contribute to rising rents and reduced housing affordability, potentially increasing the risk of homelessness for low-income individuals and families.

Are there examples of private equity firms influencing homelessness rates?

Yes, in some cities, private equity ownership of large rental portfolios has been linked to rent hikes and evictions, which can exacerbate homelessness. However, the relationship is complex and influenced by multiple factors.

What measures can mitigate the negative effects of private equity on housing affordability?

Policies such as rent control, affordable housing development incentives, and regulations on rental practices can help protect tenants and reduce homelessness risks associated with private equity investments.