Understanding the Bedrock: What is Investing?

Before you embark on the journey of building an investment portfolio, it is crucial to establish a foundational understanding of what investing truly entails. Investing, at its core, is the allocation of resources, typically money, with the expectation of generating a future return. This return can manifest as appreciation in asset value, regular income streams, or a combination of both. It differs fundamentally from saving, which primarily focuses on preserving capital. Investing, conversely, inherently involves a degree of risk, as the value of your investments can fluctuate. Your objective as an investor is to manage this risk judiciously while maximizing your potential for growth. Think of investing as planting a seed: you provide it with resources (your capital), nurture it (monitor and adjust your portfolio), and patiently wait for it to grow into a mature plant, yielding fruit (your returns). You can find the best tax apps for managing your finances at tax apps.

The Distinction Between Investing and Speculation

While often conflated, investing and speculation are distinct activities. Investing is characterized by a long-term perspective, a thorough analysis of underlying assets, and an expectation of reasonable returns. Speculation, on the other hand, involves short-term plays, a higher tolerance for risk, and an emphasis on market timing rather than fundamental value. Your goal as a beginner should be to invest, not speculate. Speculation, akin to gambling, relies heavily on chance and often leads to significant losses for inexperienced participants.

The Role of Compounding

One of the most powerful forces in investing is compound interest, often referred to as “the eighth wonder of the world.” Compounding is the process where the returns you earn on your initial investment also earn returns. Over time, this snowball effect can significantly amplify your wealth. Imagine a snowball rolling down a hill: it starts small, but as it picks up more snow, it grows exponentially. The earlier you begin investing, the more time compounding has to work its magic.

Defining Your Investment Goals and Risk Tolerance

Before you even consider which assets to purchase, you must first define your investment goals and assess your personal risk tolerance. These two factors will serve as the guiding principles for all your investment decisions. Without clear objectives, your portfolio will lack direction, much like a ship without a compass.

Identifying Your Investment Objectives

Your investment objectives are the specific financial targets you aim to achieve through investing. These can vary widely depending on your life stage and personal circumstances.

- Short-Term Goals: These might include saving for a down payment on a house, funding a significant purchase within the next few years, or creating an emergency fund. For these goals, liquidity and capital preservation often take precedence over high returns, making lower-risk investments more suitable.

- Medium-Term Goals: These could encompass saving for a child’s education, funding a sabbatical, or undertaking a large home renovation project. These goals typically have a time horizon of 5-10 years, allowing for a slightly higher allocation to growth-oriented assets.

- Long-Term Goals: Retirement planning is the quintessential long-term investment goal. Other long-term objectives might include generating passive income or leaving a financial legacy. For these goals, you have the luxury of time, allowing you to embrace more volatile, but potentially higher-returning, assets.

Assessing Your Risk Tolerance

Risk tolerance is your psychological and financial capacity to withstand fluctuations in the value of your investments. It’s a deeply personal metric that influences the types of assets you choose and the overall composition of your portfolio.

- Financial Capacity for Risk: This refers to your ability to absorb potential losses without significantly impacting your financial well-being. Factors such as your income stability, existing debt, and emergency savings contribute to this assessment.

- Psychological Comfort with Risk: This is your emotional response to market volatility. Some individuals are comfortable seeing their portfolio temporarily decline, understanding it’s part of the investment landscape, while others experience significant anxiety. Be honest with yourself about how you would react to a market downturn.

- Time Horizon: Generally, the longer your investment horizon, the greater your capacity to take on risk. Short-term market fluctuations become less significant when viewed through a decades-long lens.

Diversification: The Cornerstone of Risk Management

Diversification is perhaps the most fundamental principle of prudent investing. It involves spreading your investments across various asset classes, industries, and geographical regions to mitigate risk. Think of it as not putting all your eggs in one basket. If one basket falls, you don’t lose all your eggs.

Understanding Asset Classes

Different asset classes behave differently under various economic conditions, providing a natural hedge against volatility. The primary asset classes you should consider include:

- Equities (Stocks): Represent ownership in a company. They offer the potential for significant long-term growth but also come with higher volatility. Your return is derived from capital appreciation (the stock price increasing) and dividends (a portion of the company’s profits distributed to shareholders).

- Fixed Income (Bonds): Essentially loans you make to governments or corporations. They are generally considered less risky than stocks and provide a predictable income stream through interest payments. Their value tends to be less volatile than stocks, making them a good ballast in a portfolio.

- Cash and Cash Equivalents: Highly liquid investments, such as savings accounts, money market funds, and short-term certificates of deposit (CDs). They offer minimal returns but provide safety and liquidity, essential for emergency funds.

- Real Estate: Can provide both capital appreciation and rental income. It’s often considered a long-term investment due to its illiquidity and significant transaction costs.

- Commodities: Raw materials such as gold, oil, and agricultural products. They can act as an inflation hedge but are often volatile and require specialized knowledge.

The Benefits of Diversification

Diversification offers several key advantages:

- Reduced Volatility: By not being overly concentrated in a single asset or sector, you cushion the impact of poor performance from any one investment. When one part of your portfolio is down, another might be up, smoothing out overall returns.

- Improved Risk-Adjusted Returns: While diversification doesn’t guarantee higher returns, it can help you achieve a more favorable return for the level of risk you take.

- Protection Against Unforeseen Events: Economic downturns, industry-specific challenges, or geopolitical events can severely impact specific investments. Diversification helps you weather these storms more effectively.

Diversification Beyond Asset Classes

Beyond diversifying across asset classes, you should also consider:

- Geographical Diversification: Invest in companies and markets across different countries and regions to reduce your reliance on a single economy.

- Sector Diversification: Avoid over-concentration in a single industry. If you work in technology, for instance, it might be wise to diversify into other sectors to avoid having too much of your financial well-being tied to one industry.

- Company-Specific Diversification: Even within a specific asset class, avoid putting too much capital into a single company.

Choosing Your Investment Vehicles

Once you understand your goals, risk tolerance, and the importance of diversification, you can start selecting the specific investment vehicles that will populate your portfolio. Begin with simpler, broadly diversified options before venturing into more complex instruments.

Mutual Funds and Exchange-Traded Funds (ETFs)

For most beginner investors, mutual funds and ETFs are excellent starting points. They offer instant diversification and professional management.

- Mutual Funds: These are professionally managed portfolios of stocks, bonds, or other securities. When you invest in a mutual fund, you are pooling your money with other investors, and the fund manager then uses this collective capital to buy various assets.

- Advantages: Diversification, professional management, convenience.

- Disadvantages: Can have higher fees (expense ratios), lack intraday trading flexibility.

- Exchange-Traded Funds (ETFs): Similar to mutual funds in that they hold a basket of securities, but they trade on stock exchanges like individual stocks.

- Advantages: Lower expense ratios than many mutual funds, intraday trading flexibility, transparency (you know what holdings are within the ETF).

- Disadvantages: Brokerage commissions on trades (though many platforms offer commission-free ETF trading).

Index Funds

A particularly effective type of mutual fund or ETF for beginners is the index fund. These funds passively track a specific market index, such as the S&P 500 (which represents 500 of the largest U.S. companies).

- Advantages: Extremely low expense ratios, broad diversification, historically robust returns (as they track the market as a whole), no need for active management decisions.

- Disadvantages: You will only achieve market returns, not outperform them.

Individual Stocks and Bonds (With Caution)

While more advanced, you can also invest directly in individual stocks and bonds.

- Individual Stocks: Owning shares of individual companies requires significant research and a deep understanding of financial statements, industry trends, and competitive landscapes. It also carries higher specific risk.

- Recommendation for Beginners: Start with fundamentally sound, large-cap companies if you choose this route, but prioritize index funds and ETFs initially.

- Individual Bonds: Investing directly in bonds can provide predictable income. However, understanding bond yields, credit ratings, and interest rate risk is crucial.

- Recommendation for Beginners: Bond ETFs or mutual funds are generally a more suitable starting point as they offer diversification and simplified management.

Long-Term Perspective and Regular Portfolio Review

Investing effectively is not a sprint; it’s a marathon. Maintaining a long-term perspective and regularly reviewing your portfolio are crucial practices for sustained success. Impatient decisions, often driven by short-term market fluctuations, are frequently detrimental.

The Importance of a Long-Term Outlook

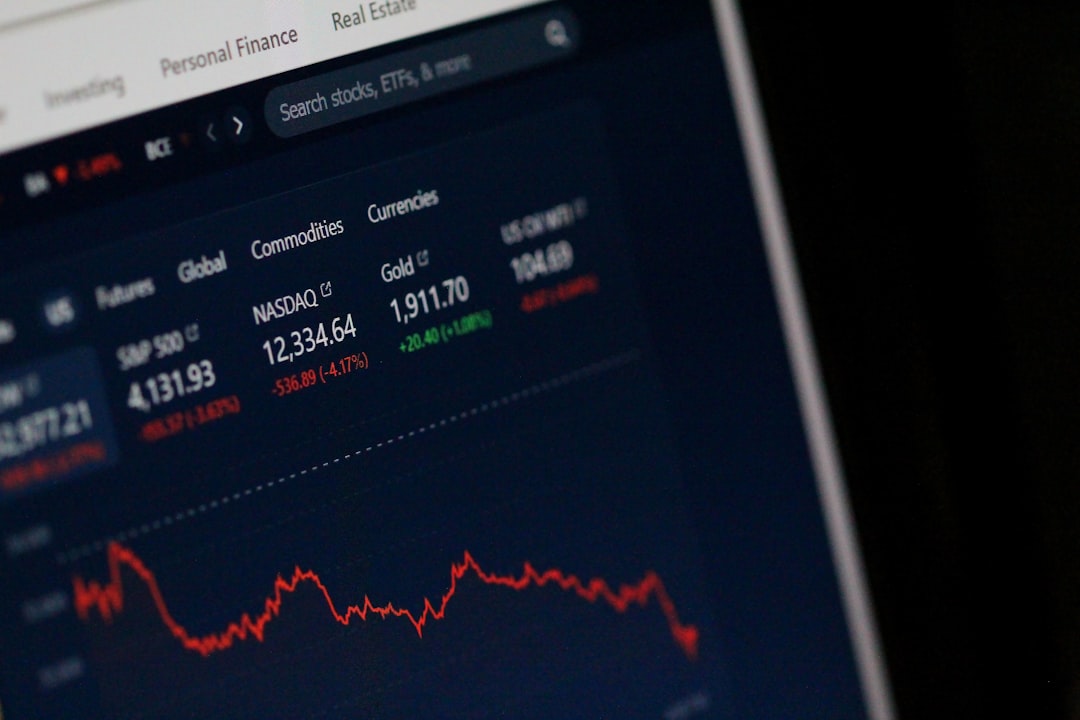

Market volatility is an inherent part of investing. Stock markets experience downturns, sometimes severe ones, but historically, they have always recovered and reached new highs over the long term.

- Avoid Market Timing: Attempting to predict the short-term movements of the market is an exercise in futility for most investors. It often leads to buying high and selling low, eroding your returns. Stay invested through market cycles.

- Embrace Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. When prices are high, your fixed amount buys fewer shares; when prices are low, it buys more shares. Over time, this averages out your purchase price and reduces the risk of making a single, poorly timed investment. Think of it as consistently feeding your investment plant a fixed amount of nutrients, regardless of whether the sun is shining brightly or hiding behind clouds.

Regular Portfolio Review and Rebalancing

Your investment portfolio is not a static entity; it needs periodic attention to ensure it remains aligned with your goals and risk tolerance.

- Annual or Semi-Annual Review: Schedule regular times to review your portfolio. During this review, consider:

- Your Financial Goals: Have they changed? Do you need to adjust your savings rate or investment strategy?

- Your Risk Tolerance: Has your comfort with risk evolved due to life changes or increased experience?

- Portfolio Performance: How has each investment performed relative to its benchmarks and your expectations?

- Rebalancing: Over time, different assets in your portfolio will grow at different rates, causing your initial asset allocation to drift. Rebalancing involves adjusting your portfolio back to your target allocation.

- How it Works: If stocks have performed exceptionally well, they might now represent a larger percentage of your portfolio than you intended. Rebalancing would involve selling some of your outperforming stocks and buying more of your underperforming assets (e.g., bonds) to restore your original target percentages. This strategy helps to “buy low and sell high” systematically.

- Benefits: Helps control risk by preventing over-concentration in assets that have become disproportionately large and ensures your portfolio remains aligned with your desired risk level.

By understanding these fundamental principles and consistently applying them, you will lay a strong foundation for building a robust investment portfolio that serves your financial aspirations over the long term. Remember, informed action and patience are your most valuable assets in the world of investing.

WATCH THIS 🛑 INVISIBLE TAX: Apps Steal $843/Year Without You Noticing (Here’s How)

FAQs

What is an investment strategy for beginners?

An investment strategy for beginners is a plan designed to help new investors allocate their money in various financial assets to achieve specific financial goals while managing risk. It typically involves understanding basic investment principles, setting clear objectives, and choosing suitable investment options.

Why is it important to have an investment strategy as a beginner?

Having an investment strategy is important because it provides a structured approach to investing, helps manage risks, prevents emotional decision-making, and increases the likelihood of achieving long-term financial goals.

What are common types of investments recommended for beginners?

Common investments for beginners include diversified mutual funds, exchange-traded funds (ETFs), index funds, bonds, and blue-chip stocks. These options generally offer lower risk and are easier to manage compared to individual stocks or more complex financial instruments.

How much money should a beginner start investing with?

There is no fixed amount to start investing; beginners can start with as little as a few hundred dollars. The key is to invest an amount that fits within their budget and financial situation, ensuring they can maintain the investment over time.

What role does diversification play in a beginner’s investment strategy?

Diversification involves spreading investments across different asset classes and sectors to reduce risk. For beginners, diversification helps protect their portfolio from significant losses by not relying on a single investment or market segment.