The housing affordability crisis is a complex web, and one thread that has become increasingly prominent is the role of private equity. You might have heard of private equity firms – behemoths that swoop in, acquire companies, and aim to make them more profitable. Increasingly, these financially powerful entities are setting their sights on the housing market, particularly residential rental properties. This has led to a growing debate about whether their involvement is a stabilizing force or a significant contributor to the affordability challenges you face.

The past decade has seen a dramatic increase in private equity firms identifying residential real estate, especially single-family rental homes, as a lucrative investment vehicle. Historically, real estate investment for these firms often focused on commercial properties. However, the wake of the 2008 financial crisis, which left a glut of foreclosed homes, presented an unprecedented opportunity. Private equity saw a chance to acquire large portfolios of distressed assets at low prices, essentially buying up the housing stock when it was on sale.

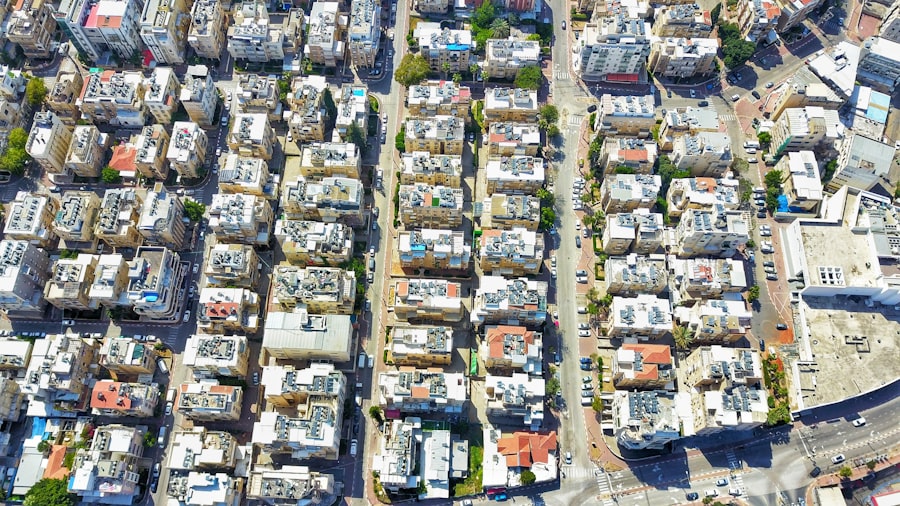

The Shifting Landscape of Homeownership

Your traditional vision of homeownership, a cornerstone of the American dream and a pathway to building wealth, has been subtly but fundamentally altered. As private equity firms amassed vast numbers of houses, they shifted the landscape from a fragmented market of individual landlords to one dominated by corporate entities. This transition has had ripple effects, impacting everything from the types of properties available to the very nature of your landlord-tenant relationship. You’re no longer just dealing with a neighbor who owns a few houses; you’re engaging with sophisticated financial institutions with profit maximization as their primary directive.

The “Buy-to-Rent” Strategy

The core strategy employed by many private equity firms in this sector is known as “buy-to-rent.” They acquire homes in bulk, often through auctions or by purchasing entire portfolios from other investors. Their goal is to transform these individual homes into a stabilized income-generating asset. This involves professionalizing property management, optimizing rental rates, and aiming for long-term appreciation of the property’s value.

The Scale of Acquisition

It’s not just a few houses here and there. Private equity firms have established dedicated platforms for acquiring and managing residential properties, often operating under subsidiary names. These entities can deploy billions of dollars, allowing them to outbid individual homebuyers and first-time buyers in many markets. This can feel like playing a rigged game, where the deck is stacked against you from the moment you enter the bidding war.

The Financial Engineering Behind the Acquisitions

The capital for these acquisitions doesn’t come from the pockets of a few wealthy individuals. It’s pooled from a diverse range of investors, including pension funds, endowments, sovereign wealth funds, and wealthy individuals. This broad investor base allows private equity firms to undertake massive acquisitions that are beyond the reach of most individual investors. The sheer financial firepower means they can absorb market fluctuations and execute strategies that might be too risky for smaller players.

The intersection of private equity and the housing affordability crisis has become a pressing issue in recent years, as investment firms increasingly acquire residential properties, driving up rents and limiting access for many families. For a deeper understanding of how these dynamics play out in the current market, you can read a related article that explores the implications of private equity’s role in housing. Check it out here: How Wealth Grows.

The Impact on Rental Markets

The most direct and palpable effect of private equity’s increasing presence is felt within the rental market. As these large portfolios are added to the rental stock, they fundamentally alter the dynamics of supply, demand, and pricing. You’ve likely experienced this firsthand, with rising rents and a shrinking supply of affordable options.

Rent Increases and Rent Control Debates

A primary concern is the tendency for private equity landlords to increase rents at a faster pace than traditional landlords. Armed with sophisticated data analytics and a mandate to maximize returns for their investors, these firms are often highly efficient at identifying opportunities to raise rents. This can put immense pressure on households, especially those with lower or fixed incomes, who may struggle to keep pace. This has fueled debates around rent control and other tenant protections, as you seek ways to stabilize your housing costs.

Data-Driven Rent Setting

Private equity firms employ advanced data analysis to determine optimal rental prices. They consider factors like local market comparable rents, property amenities, economic conditions, and tenant demographics. This data-driven approach, while efficient from a business perspective, can lead to more aggressive rent hikes as it identifies the maximum price the market will bear, rather than a price that considers tenant stability.

The Absence of Personal Connection

Unlike a smaller landlord who might be more flexible during tough times, private equity firms operate on a more impersonal and transactional basis. This can translate into less leniency regarding late payments or requests for rent reductions, even in extenuating circumstances. The human element that can sometimes provide a buffer for tenants is often absent.

Property Management and Tenant Services

The professionalization of property management is often cited as a benefit, but it can also have drawbacks for tenants. While you may experience more responsive maintenance requests, the overall tenant experience can feel less personal. Leases are often standardized and rigidly enforced, with little room for negotiation.

Streamlined Maintenance and Repairs

On the positive side, private equity firms often invest in upgrading properties and streamlining maintenance processes. This can lead to quicker responses to repair requests and a generally better upkeep of the properties. You might find that the leaky faucet gets fixed faster or that common areas are better maintained.

The Impersonal Nature of Leases and Communications

However, this efficiency can come at the cost of personalization. Lease agreements are typically non-negotiable, and communication often happens through online portals or standardized forms rather than direct conversations with a property owner. This can leave you feeling like a number in a system rather than an individual with unique needs.

The Impact on Housing Supply

While private equity firms are acquiring existing homes and bringing them onto the rental market, this doesn’t necessarily translate to an increase in affordable housing supply. In fact, their focus can sometimes exacerbate shortages in specific price ranges.

Targeting Mid-to-High Tier Properties

Many private equity firms tend to focus on acquiring well-located, mid-to-high tier single-family homes. These are the types of properties that are more likely to generate higher rental income and appreciate in value. This can leave a significant gap in the supply of starter homes or more affordable rental units, pushing those at the lower end of the market into even more competitive and expensive situations. When they buy up these desirable homes, they remove them from the market for potential first-time homebuyers, further constricting accessibility.

The Conversion of Homes from Potential Ownership to Rentals

When private equity firms purchase homes that might otherwise have been bought by families looking to own, they effectively convert these properties from potential owner-occupied residences into rental units. This shrinks the available inventory for aspiring homeowners and can contribute to the sense that homeownership is becoming an unattainable goal.

The Role in Homeownership Affordability

Beyond the rental market, private equity’s actions have a significant indirect impact on your ability to afford to buy a home. This influence is often subtle but deeply impactful, particularly for first-time homebuyers.

Competition with Individual Buyers

The sheer scale of private equity acquisitions means they are direct competitors with individual homebuyers, especially in desirable markets. When bidding on a property, you’re often up against an entity with vast financial resources, capable of making all-cash offers and waiving contingencies. This creates an uneven playing field that can be demoralizing for those trying to enter the housing market. It’s like trying to win a race when one of the competitors has a jetpack.

All-Cash Offers and Contingency Waivers

Private equity firms can often make all-cash offers, eliminating the need for a mortgage. This is a huge advantage, as it removes the uncertainty and delay associated with loan approvals. Furthermore, they can waive contingencies like home inspections or financing clauses, making their offers more attractive to sellers who want a quick and guaranteed sale. You, on the other hand, might need to secure financing and conduct thorough inspections, putting you at a disadvantage.

Driving Up Property Prices

The aggressive acquisition strategies of private equity can contribute to bidding wars and, consequently, drive up property prices. As these firms compete for limited inventory, they can push prices beyond what a typical household can afford. This inflation of the market makes it harder for you to save for a down payment and qualify for a mortgage.

The Impact on the Rental-to-Ownership Pipeline

For many, renting is a stepping stone to homeownership. However, when private equity firms acquire a large number of entry-level homes and keep them as rentals, they can disrupt this traditional pathway.

Limiting the Availability of Starter Homes

If the homes that were once attainable for first-time buyers are now held by large investment firms, the pipeline of starter homes for sale shrinks. This means fewer opportunities for you to build equity and transition into homeownership. You might be stuck in the rental cycle for longer, paying rent that could otherwise be building your wealth.

The “Institutionalization” of Rental Housing

The rise of large, institutional landlords can change the perception and accessibility of rental housing. Instead of a diverse market with a range of landlords, you might be dealing with a few dominant players. This can reduce options and create a more homogenized rental landscape, potentially limiting the diversity of housing stock available for those who are not yet ready or able to buy.

Critiques and Concerns Regarding Private Equity’s Role

The increasing involvement of private equity in housing has not gone unnoticed. Critics point to several serious concerns about the long-term implications for housing affordability and market stability.

The Profit-Maximization Imperative

The fundamental critique is that private equity firms are driven by profit maximization for their investors. While this is their business model, it can lead to decisions that prioritize short-term gains over long-term community well-being or tenant stability. This can manifest in aggressive rent hikes, property disinvestment if a market becomes less profitable, or a lack of investment in social amenities.

The Short-Term vs. Long-Term Horizon

Private equity has a defined investment horizon, typically 5-10 years. This means they are looking for quick returns before exiting their investment. Critics argue this short-term focus can lead to decisions that benefit quick profits but don’t necessarily build sustainable, affordable housing communities. They may churn properties or extract as much value as possible without reinvesting for the long haul.

The Impact on Local Communities

When large swathes of housing are owned by distant, corporate entities, there can be a disconnect from the needs of the local community. Decisions about property management, rent levels, and amenity investments are made from a financial perspective, which may not align with the social fabric or economic realities of the neighborhood. Local concerns can be drowned out by the global reach of financial capital.

The Issue of Transparency and Accountability

The complex ownership structures of private equity firms can make it difficult to pinpoint accountability. When issues arise with properties or tenants, it can be challenging to identify who is ultimately responsible. This opacity can make it harder for tenants, regulators, and policymakers to understand and address problems effectively.

Complex Ownership Structures

Private equity firms often operate through layers of subsidiaries and limited liability companies. This labyrinthine structure can obscure ultimate ownership and decision-making authority, making it difficult for tenants to know who to hold responsible for issues like repairs or unfair practices.

Regulatory Challenges

The decentralized nature of housing and the intricate web of corporate ownership present significant challenges for regulators. It can be difficult to apply consistent oversight and ensure compliance with housing laws when dealing with numerous entities across different jurisdictions.

The intersection of private equity and the housing affordability crisis has become a pressing issue in recent years, as investment firms increasingly acquire residential properties, driving up rents and limiting access for many families. A related article discusses the implications of this trend and explores potential solutions to mitigate the impact on low-income households. For more insights on this topic, you can read the article here. Understanding the dynamics of private equity’s role in the housing market is crucial for addressing the ongoing affordability challenges faced by communities across the country.

Potential Solutions and Policy Considerations

| Metric | Value | Source/Year | Notes |

|---|---|---|---|

| Percentage of Single-Family Homes Owned by Private Equity | Approximately 2% | Urban Institute, 2023 | Private equity firms have increased ownership in single-family rental homes. |

| Increase in Rent Prices in Private Equity-Owned Properties | 10-15% higher than market average | Harvard Joint Center for Housing Studies, 2022 | Private equity ownership linked to higher rent growth. |

| Share of New Home Purchases by Private Equity Firms | Up to 20% in some metropolitan areas | CoreLogic, 2023 | Concentration varies by region, higher in Sun Belt cities. |

| Impact on Housing Affordability Index | Decrease by 5-7 points in affected markets | National Low Income Housing Coalition, 2023 | Private equity activity correlates with reduced affordability. |

| Average Time to Eviction in Private Equity-Owned Rentals | 30 days | Eviction Lab, 2023 | Faster eviction processes compared to traditional landlords. |

Addressing the role of private equity in the housing affordability crisis requires a multifaceted approach involving policy changes, increased transparency, and potentially new investment models. The goal is to ensure that the pursuit of profit doesn’t undermine the fundamental need for safe, stable, and affordable housing.

Increased Regulation and Oversight

One of the most discussed solutions is to increase regulatory oversight of large institutional landlords, including private equity firms. This could involve stricter rules around rent increases, eviction processes, and property maintenance standards.

Strengthening Tenant Protections

Implementing or strengthening rent control measures, providing greater eviction protections, and ensuring clear pathways for tenant recourse against unfair practices are all policy options being explored. These measures aim to create a more equitable balance of power between landlords and tenants.

Disclosure Requirements

Requiring greater transparency in ownership structures and disclosure of financial performance related to residential rental portfolios could help hold firms more accountable and provide valuable data for policymakers. Knowing who owns what and how they are operating is a crucial first step to any effective solution.

Promoting Alternative Ownership Models

Encouraging and supporting alternative ownership models could offer a counterpoint to the dominance of private equity. This includes fostering community land trusts, housing cooperatives, and other non-profit or resident-owned housing solutions.

Community Land Trusts

Community land trusts are non-profit organizations that acquire land and hold it in trust for the benefit of the community. Housing built on this land is then sold or rented at affordable rates, with the land trust retaining ownership of the land to ensure long-term affordability.

Resident-Owned Housing

Promoting models where residents have a direct stake in the ownership and management of their housing can create more stable and equitable communities. This could involve tenant ownership of rental buildings or co-housing initiatives.

Addressing the Root Causes of the Crisis

Ultimately, the role of private equity is a symptom of a larger housing affordability crisis. A comprehensive strategy must also address the underlying issues that have led to soaring housing costs in the first place, such as insufficient housing supply, restrictive zoning laws, and stagnant wage growth for many households. Without tackling these fundamental problems, even significant changes to how private equity operates might only be a partial solution. You need to consider the entire ecosystem of housing, not just one player within it.

WATCH NOW ▶️ SHOCKING: Why Wall Street Is Buying Your Neighborhood

FAQs

What role does private equity play in the housing market?

Private equity firms invest in residential real estate by purchasing large portfolios of homes, often converting them into rental properties. Their involvement can influence housing supply, rental prices, and homeownership rates.

How can private equity impact housing affordability?

Private equity ownership can lead to increased rents and reduced availability of affordable homes, as firms seek to maximize returns. This may contribute to higher housing costs and limit access to affordable housing for many families.

Why are private equity firms interested in residential real estate?

Residential real estate offers private equity firms stable cash flow through rental income and potential appreciation. The housing market can provide attractive investment opportunities, especially in areas with high demand and limited supply.

What are some criticisms of private equity involvement in housing?

Critics argue that private equity firms prioritize profits over tenants’ well-being, leading to rent hikes, reduced maintenance, and displacement of long-term residents. Their large-scale acquisitions can also reduce the availability of homes for purchase by individual buyers.

Are there any regulations addressing private equity’s impact on housing affordability?

Some local and national governments have introduced policies to regulate rental increases, improve tenant protections, and limit large-scale acquisitions by institutional investors. However, regulatory approaches vary widely and are often debated in terms of effectiveness.