As a landlord, navigating the complexities of the tax code can feel overwhelming.

You need to familiarize yourself with the various classifications of income and expenses associated with your rental properties.

For instance, rental income is generally considered passive income, which means it is subject to different tax rules than earned income from a job. This distinction is essential as it influences how you report your earnings and what deductions you can claim. Moreover, the tax code allows you to treat your rental property as a business, which opens up a range of deductions and credits that can significantly reduce your taxable income.

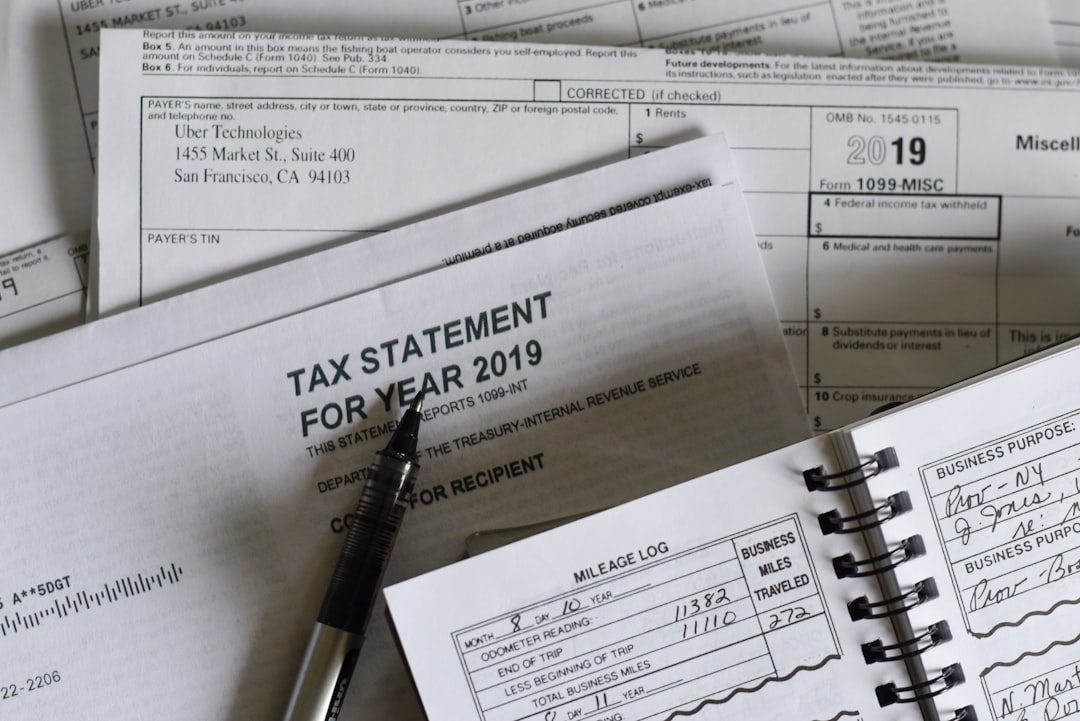

You should be aware of the importance of keeping meticulous records of all transactions related to your rental properties. This includes not only the income you receive but also any expenses incurred in managing and maintaining the property. By maintaining detailed records, you can ensure that you are prepared for any potential audits and can take full advantage of the deductions available to you.

Key Takeaways

- Landlords can reduce taxable income through depreciation and deductible expenses.

- 1031 exchanges allow deferral of capital gains taxes when reinvesting in similar properties.

- The Qualified Business Income Deduction offers additional tax savings for eligible rental activities.

- Rental property improvements and financing have specific tax benefits that can enhance returns.

- Understanding passive activity loss rules and strategic tax planning helps landlords maximize overall tax advantages.

Depreciation and its Benefits for Landlords

Depreciation is one of the most powerful tax benefits available to landlords, allowing you to recover the cost of your property over time. As a landlord, you can depreciate the value of your rental property, excluding the land, over a period of 27.5 years for residential properties. This means that each year, you can deduct a portion of the property’s value from your taxable income, effectively reducing your overall tax burden.

Understanding how depreciation works is vital for maximizing your tax benefits and improving your cash flow. In addition to the standard depreciation deduction, you may also be eligible for bonus depreciation on certain improvements made to your property. This allows you to deduct a significant portion of the cost of improvements in the year they are made rather than spreading it out over several years.

By taking advantage of these depreciation strategies, you can significantly enhance your financial position as a landlord, allowing you to reinvest in your properties or save for future investments.

Deductible Expenses for Landlords

As a landlord, you have the opportunity to deduct a wide range of expenses associated with managing and maintaining your rental properties. These deductible expenses can include mortgage interest, property taxes, insurance premiums, repairs, maintenance costs, and even utilities if you cover them for your tenants. By understanding what qualifies as a deductible expense, you can effectively lower your taxable income and keep more money in your pocket.

It’s important to note that not all expenses are created equal; some may be fully deductible in the year they are incurred, while others may need to be capitalized and depreciated over time. For example, routine repairs that keep your property in good condition are typically fully deductible in the year they are paid. In contrast, improvements that add value or extend the life of the property must be capitalized and depreciated over several years.

Keeping detailed records and receipts for all expenses will help you accurately report them on your tax return and ensure that you maximize your deductions.

Taking Advantage of 1031 Exchanges

| Metric | Description | Typical Value/Range | Notes |

|---|---|---|---|

| Tax Deferral Percentage | Percentage of capital gains tax deferred by using a 1031 exchange | 100% | Entire capital gains tax can be deferred if rules are followed |

| Identification Period | Time allowed to identify replacement property after sale | 45 days | Strict deadline to identify potential replacement properties |

| Exchange Period | Time allowed to complete the purchase of replacement property | 180 days | Includes the 45-day identification period |

| Minimum Investment | Amount required to reinvest to fully defer capital gains tax | Equal or greater than sale price of relinquished property | Must reinvest all proceeds to avoid partial tax liability |

| Eligible Property Types | Types of properties that qualify for 1031 exchange | Investment or business real estate | Personal residences do not qualify |

| Boot | Non-like-kind property or cash received in exchange | Any amount | Triggers partial capital gains tax on the boot amount |

| Qualified Intermediary Fee | Cost to use a third party to facilitate the exchange | 300 – 1,000 | Varies based on complexity and provider |

A 1031 exchange is a powerful tool that allows landlords to defer paying capital gains taxes when selling a rental property by reinvesting the proceeds into another similar property. This strategy can be particularly beneficial if you’re looking to upgrade or diversify your real estate portfolio without incurring immediate tax liabilities. To qualify for a 1031 exchange, you must adhere to specific IRS guidelines, including identifying a replacement property within 45 days and completing the purchase within 180 days.

By utilizing a 1031 exchange, you can leverage the equity in your current property to acquire a more valuable asset or expand into different markets without facing immediate tax consequences. This strategy not only helps you defer taxes but also allows you to grow your wealth through real estate investments more efficiently. However, it’s essential to work with a qualified intermediary and understand the rules governing 1031 exchanges to ensure compliance and maximize the benefits.

Utilizing the Qualified Business Income Deduction

The Qualified Business Income (QBI) deduction is another valuable tax benefit available to landlords who operate their rental properties as a business. Under this provision, you may be eligible to deduct up to 20% of your qualified business income from your taxable income. To qualify for this deduction, you must meet specific criteria, including demonstrating that your rental activities constitute a trade or business under IRS guidelines.

To maximize your QBI deduction, it’s crucial to maintain thorough records of your rental activities and demonstrate that you are actively engaged in managing your properties. This may include keeping track of hours spent on property management tasks or documenting efforts to improve tenant relations. By ensuring that you meet the requirements for the QBI deduction, you can significantly reduce your taxable income and enhance your overall financial position as a landlord.

Tax Benefits of Rental Property Improvements

Investing in improvements for your rental properties can yield significant tax benefits while also enhancing their value and appeal to tenants. When you make improvements—such as renovating kitchens or bathrooms or upgrading HVAC systems—you not only increase the property’s market value but also create opportunities for tax deductions through depreciation. While these improvements must be capitalized rather than deducted in full in the year they are made, they can still provide substantial long-term tax advantages.

Additionally, certain improvements may qualify for energy efficiency tax credits or other incentives designed to encourage sustainable practices in real estate. By researching available programs and taking advantage of these opportunities, you can offset some of the costs associated with improvements while also contributing positively to environmental sustainability. Ultimately, investing in your rental properties not only enhances their value but also provides avenues for tax savings that can benefit your bottom line.

Capital Gains Tax and How to Minimize it

When selling a rental property, understanding capital gains tax is crucial for effective tax planning. Capital gains tax is assessed on the profit made from selling an asset, such as real estate. As a landlord, if you’ve owned the property for more than one year, you’ll typically be subject to long-term capital gains rates, which are generally lower than ordinary income tax rates.

However, if you’re not careful with your planning, these taxes can significantly impact your profits from the sale. To minimize capital gains tax liability, consider strategies such as utilizing a 1031 exchange or offsetting gains with losses from other investments (a strategy known as tax-loss harvesting). Additionally, keeping detailed records of all improvements made to the property can help increase your basis in the property, thereby reducing taxable gains when it comes time to sell.

By being proactive about capital gains tax planning, you can retain more of your profits and reinvest them into future opportunities.

Utilizing the Home Office Deduction for Landlords

If you’re managing rental properties from home, you may qualify for the home office deduction, which allows you to deduct certain expenses related to maintaining a home office space used exclusively for business purposes. This deduction can include a portion of mortgage interest, utilities, insurance, and repairs based on the percentage of your home used for business activities. As a landlord who actively manages properties from home, this deduction can provide significant savings on your overall tax bill.

To qualify for this deduction, it’s essential to ensure that your home office meets IRS requirements for exclusivity and regular use. Keeping accurate records of expenses related to your home office will help substantiate your claims during tax season. By taking advantage of this deduction, you can further reduce your taxable income while effectively managing your rental properties from the comfort of home.

Tax Benefits of Rental Property Financing

Financing options for rental properties come with their own set of tax benefits that landlords should be aware of when managing their investments. Mortgage interest is one of the most significant deductions available to landlords; you can deduct interest paid on loans used to acquire or improve rental properties from your taxable income. This deduction can substantially reduce your overall tax liability and improve cash flow.

Additionally, if you’re using financing options such as home equity lines of credit (HELOCs) or other loans for investment purposes, interest paid on these loans may also be deductible if used for qualifying expenses related to rental properties. Understanding how financing impacts your taxes allows you to make informed decisions about leveraging debt effectively while maximizing potential deductions.

Understanding Passive Activity Loss Rules

The IRS classifies rental activities as passive activities unless you’re considered a real estate professional. This classification has significant implications for how losses from rental properties are treated on your tax return. Generally speaking, passive losses can only offset passive income; however, there are exceptions that may allow you to deduct losses against ordinary income under certain circumstances.

If you’re actively involved in managing your rental properties—spending at least 750 hours per year—you may qualify for special treatment under passive activity loss rules. This could allow you to deduct losses against other sources of income if certain criteria are met. Understanding these rules is essential for effective tax planning and ensuring that you’re maximizing any potential losses that could benefit your overall financial situation.

Tax Planning Strategies for Landlords

Effective tax planning is essential for landlords looking to optimize their financial outcomes while minimizing liabilities. One key strategy involves timing expenses and income recognition strategically throughout the year; by deferring income or accelerating expenses into a given tax year, you may be able to lower taxable income significantly. Additionally, consider consulting with a tax professional who specializes in real estate; they can provide tailored advice based on current laws and regulations while helping identify opportunities specific to your situation.

Staying informed about new legislation affecting landlords—such as changes in depreciation rules or deductions—can help ensure that you’re making informed decisions about managing your properties effectively while maximizing potential benefits at tax time. By implementing proactive strategies and seeking professional guidance when needed, you can navigate the complexities of taxation as a landlord with confidence and success.

Landlords can take advantage of various tax code benefits that can significantly enhance their investment returns. For a deeper understanding of these advantages, you can read the article on tax strategies for property owners at How Wealth Grows. This resource provides valuable insights into deductions, depreciation, and other financial strategies that can help maximize profitability in real estate investments.

FAQs

What are tax code advantages available to landlords?

Landlords can benefit from various tax code advantages such as deductions for mortgage interest, property depreciation, repairs and maintenance costs, property management fees, and certain travel expenses related to managing rental properties.

Can landlords deduct mortgage interest on their rental properties?

Yes, landlords can generally deduct the mortgage interest paid on loans used to acquire or improve rental properties as a business expense.

What is property depreciation and how does it benefit landlords?

Property depreciation allows landlords to deduct the cost of the property (excluding land) over a set period, typically 27.5 years for residential rental properties, reducing taxable income each year.

Are repairs and maintenance costs deductible for landlords?

Yes, expenses for repairs and maintenance that keep the property in good condition are usually fully deductible in the year they are incurred.

Can landlords deduct expenses related to property management?

Yes, fees paid to property management companies or individuals for managing rental properties are deductible business expenses.

Are travel expenses related to rental property management deductible?

Landlords can deduct travel expenses incurred for activities such as property inspections, maintenance supervision, or tenant meetings, provided they are properly documented and directly related to the rental business.

Is rental income taxable for landlords?

Yes, rental income is generally considered taxable income and must be reported on tax returns, but landlords can offset this income with allowable deductions.

Can landlords deduct losses from rental properties?

Under certain conditions, landlords may be able to deduct rental losses against other income, especially if they actively participate in managing the property and meet income limits.

Are there special tax benefits for landlords who make energy-efficient improvements?

Yes, landlords may qualify for tax credits or deductions for making qualified energy-efficient upgrades to their rental properties, depending on current tax laws.

Should landlords keep detailed records for tax purposes?

Absolutely. Maintaining thorough records of income, expenses, receipts, and related documents is essential for accurately claiming tax advantages and substantiating deductions in case of an audit.