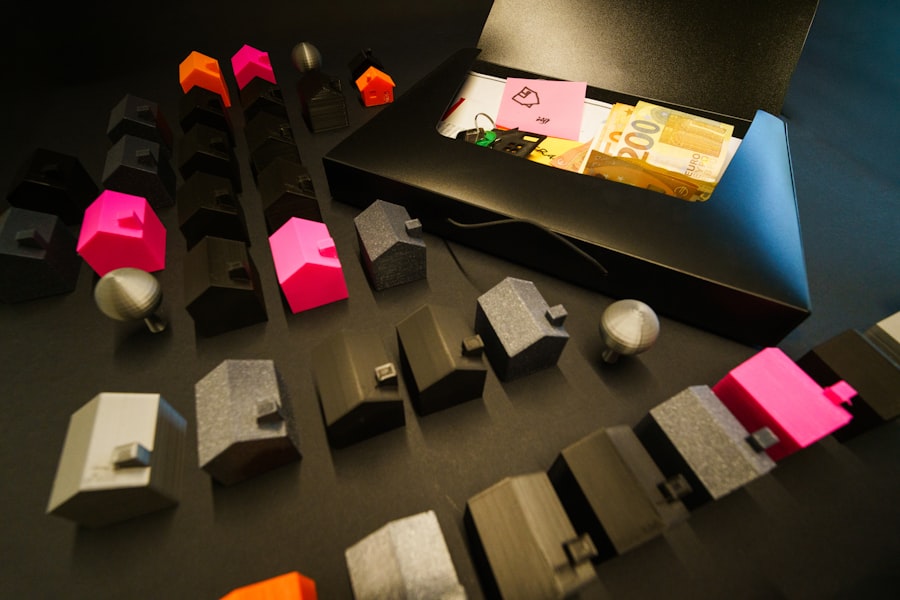

Establishing a clear savings goal forms the foundation of effective financial planning. Specific targets provide measurable objectives and maintain consistent saving behavior over time.

Effective savings goals require precise quantification. For home purchases, down payment requirements typically range from 3% to 20% of the property’s purchase price. This specific amount serves as a concrete target that can be divided into regular monthly contributions.

Clear numerical targets enable systematic progress tracking and provide benchmarks for evaluating saving performance. Timeline establishment is essential for goal achievement. Short-term objectives, such as vacation funding, require different saving strategies compared to long-term goals like retirement planning.

Defined deadlines create accountability and enable precise monthly saving calculations. For example, accumulating $20,000 for a down payment over five years requires monthly savings of approximately $333. This calculation provides clear monthly targets and enables regular progress monitoring, allowing for strategy adjustments when necessary.

Key Takeaways

- Set clear and realistic savings goals to stay motivated and focused.

- Create and adhere to a budget to manage your finances effectively.

- Automate savings and explore high-yield accounts to maximize growth.

- Consider additional income sources and employer retirement matches to boost savings.

- Research homebuying costs and seek first-time buyer programs for financial support.

Creating a budget and sticking to it

Creating a budget is an essential step in managing your finances effectively. A budget serves as a financial blueprint that outlines your income and expenses, allowing you to allocate funds toward your savings goals systematically. To create an effective budget, start by listing all sources of income, including salaries, bonuses, and any side hustles.

Next, categorize your expenses into fixed costs—such as rent or mortgage payments, utilities, and insurance—and variable costs like groceries, entertainment, and dining out. This categorization will help you identify areas where you can cut back and redirect those funds toward your savings. Once you have a clear picture of your financial situation, it is vital to stick to your budget.

This requires discipline and regular monitoring of your spending habits. Many people find it helpful to use budgeting apps or spreadsheets that allow them to track their expenses in real-time. By reviewing your budget weekly or monthly, you can identify any deviations from your plan and make necessary adjustments.

Cutting unnecessary expenses

Identifying and cutting unnecessary expenses is a critical component of effective saving strategies. Many individuals unknowingly spend money on items or services that do not significantly enhance their quality of life. Start by conducting a thorough review of your monthly expenses to pinpoint areas where you can reduce spending.

For example, subscription services for streaming platforms or gym memberships that go unused can be eliminated without much impact on your daily routine. By canceling these subscriptions, you can free up funds that can be redirected toward your savings goals. Another effective strategy is to adopt a minimalist mindset when it comes to consumer goods.

Before making any purchase, ask yourself whether the item is truly necessary or if it is simply an impulse buy. Implementing a waiting period—such as 30 days—before making significant purchases can help curb impulsive spending and allow you to evaluate whether the item is worth the investment. Additionally, consider alternatives such as buying second-hand items or borrowing from friends instead of purchasing new products.

These small changes can accumulate over time and significantly boost your savings.

Exploring different saving options, such as high-yield savings accounts or CDs

When it comes to saving money, not all accounts are created equal. Exploring various saving options can help maximize the growth of your funds over time. High-yield savings accounts are an attractive option for those looking to earn more interest on their savings compared to traditional savings accounts.

These accounts typically offer interest rates that are several times higher than the national average, allowing your money to grow more effectively while still maintaining liquidity. Many online banks offer high-yield savings accounts with minimal fees and no minimum balance requirements, making them accessible for savers at all levels. Certificates of Deposit (CDs) are another viable option for those willing to lock away their funds for a specified period in exchange for higher interest rates.

CDs typically offer fixed interest rates that are higher than those of standard savings accounts, making them an appealing choice for individuals with short- to medium-term savings goals. However, it is essential to consider the terms of the CD carefully; early withdrawal penalties can negate the benefits of higher interest rates if you need access to your funds before the maturity date. By diversifying your savings across different account types, you can optimize your returns while maintaining flexibility based on your financial needs.

Automating your savings

| Step | Action | Recommended Amount | Time Frame | Notes |

|---|---|---|---|---|

| 1 | Set a Target Home Price | Depends on local market | 1 week | Research average home prices in desired area |

| 2 | Calculate Down Payment | 10% – 20% of target home price | 1 week | Higher down payment reduces mortgage amount |

| 3 | Estimate Closing Costs | 2% – 5% of home price | 1 week | Include fees like appraisal, inspection, and legal |

| 4 | Set Monthly Savings Goal | Based on income and timeline | Ongoing | Use budgeting tools to determine affordable amount |

| 5 | Open Dedicated Savings Account | N/A | Immediate | Consider high-yield savings or money market account |

| 6 | Automate Savings | Monthly savings goal | Ongoing | Set up automatic transfers to savings account |

| 7 | Track Progress Monthly | N/A | Monthly | Adjust savings plan as needed |

| 8 | Reduce Unnecessary Expenses | Varies | Ongoing | Redirect savings to home fund |

| 9 | Consider Additional Income Sources | Varies | Ongoing | Part-time jobs, freelancing, or selling items |

| 10 | Review and Adjust Timeline | N/A | Quarterly | Ensure goals remain realistic and achievable |

Automating your savings is one of the most effective strategies for ensuring consistent contributions toward your financial goals. By setting up automatic transfers from your checking account to your savings account each month, you can make saving a seamless part of your financial routine. This approach not only simplifies the process but also helps eliminate the temptation to spend money that should be saved.

Many banks offer features that allow you to schedule these transfers on specific dates, aligning them with your paydays for optimal efficiency. In addition to automatic transfers between accounts, consider automating contributions to retirement accounts or investment platforms. Many employers offer direct deposit options that allow employees to allocate a portion of their paycheck directly into retirement accounts such as 401(k)s or IRAs.

By taking advantage of these features, you can ensure that you are consistently contributing toward long-term financial security without having to think about it actively. Over time, these automated contributions can lead to significant growth in your savings and investments due to the power of compound interest.

Considering additional sources of income, such as freelance work or a part-time job

In today’s economy, relying solely on a single source of income may not be sufficient for achieving financial goals. Exploring additional sources of income can provide the extra funds needed to bolster your savings efforts significantly. Freelancing has become increasingly popular due to its flexibility and potential for high earnings in various fields such as writing, graphic design, programming, and consulting.

Platforms like Upwork and Fiverr connect freelancers with clients seeking specific skills, allowing individuals to monetize their talents while maintaining their primary job. Alternatively, taking on a part-time job can also provide a steady stream of additional income. Many businesses offer flexible hours that can accommodate existing work schedules, making it easier for individuals to balance multiple commitments.

Whether it’s working in retail, food service, or tutoring students in subjects you excel at, part-time jobs can supplement your income and provide valuable experience in different fields. The extra earnings from these endeavors can be directly funneled into savings accounts or investment opportunities, accelerating progress toward financial goals.

Taking advantage of employer matching contributions to retirement accounts

Employer matching contributions are one of the most valuable benefits offered by many companies when it comes to retirement savings plans like 401(k)s. When an employer matches employee contributions up to a certain percentage, they essentially provide free money that can significantly enhance an employee’s retirement fund over time. For instance, if an employer matches 50% of employee contributions up to 6% of their salary, this means that for every dollar an employee contributes within that limit, they receive an additional 50 cents from their employer.

To maximize this benefit, employees should aim to contribute at least enough to receive the full match offered by their employer. Failing to do so is akin leaving money on the table; this missed opportunity can have long-term implications on retirement savings due to the compounding effect over time. By taking full advantage of employer matching contributions early in one’s career, individuals can set themselves up for greater financial security in retirement while simultaneously building good saving habits.

Avoiding large purchases that could derail your savings plan

Large purchases can pose significant risks to achieving financial goals if not approached with caution and planning. It is essential to evaluate whether such purchases align with your overall financial strategy before proceeding. For instance, buying a new car may seem appealing but could lead to substantial monthly payments that divert funds away from savings goals.

Instead of succumbing to the allure of immediate gratification through large purchases, consider alternatives such as purchasing used vehicles or delaying major expenditures until they fit comfortably within your budget. Additionally, implementing strategies like the “30-day rule” can help mitigate impulsive spending on large items. This rule encourages individuals to wait 30 days before making significant purchases; this waiting period allows time for reflection on whether the item is truly necessary or if it was merely an impulse decision driven by emotions or societal pressures.

By adopting this approach and prioritizing needs over wants, individuals can protect their savings plans from being derailed by unnecessary expenditures.

Researching and understanding the costs associated with buying a home, such as closing costs and down payments

Purchasing a home is often one of the most significant financial decisions individuals will make in their lifetime; therefore, understanding the associated costs is crucial for effective planning. While many people focus primarily on the down payment—typically ranging from 3% to 20% of the home’s purchase price—there are numerous other costs involved in buying a home that must be factored into the overall budget. Closing costs alone can range from 2% to 5% of the loan amount and may include fees for appraisals, inspections, title insurance, and attorney services.

Additionally, prospective homeowners should also consider ongoing costs such as property taxes, homeowners insurance, and maintenance expenses when budgeting for homeownership. These recurring costs can add up quickly and impact monthly cash flow significantly if not planned for adequately. By conducting thorough research on all aspects of home buying—including potential hidden costs—individuals can better prepare themselves financially and avoid surprises during the purchasing process.

Seeking out first-time homebuyer programs and grants

For many first-time homebuyers, navigating the complexities of purchasing a home can be daunting; however, various programs and grants exist specifically designed to assist individuals in overcoming financial barriers associated with homeownership. These initiatives often provide down payment assistance or favorable loan terms aimed at making homeownership more accessible for those who may struggle with traditional financing options. Local and state governments frequently offer first-time homebuyer programs that provide financial education resources alongside potential grants or low-interest loans tailored for eligible buyers.

Additionally, organizations such as Habitat for Humanity work with low-income families to help them secure affordable housing through sweat equity programs and community support initiatives. By researching available options in their area and taking advantage of these resources, first-time buyers can significantly reduce their financial burden while achieving their dream of homeownership.

Consulting with a financial advisor for personalized advice and guidance

Navigating personal finance can be overwhelming; therefore, seeking guidance from a qualified financial advisor can provide invaluable insights tailored specifically to individual circumstances and goals. Financial advisors possess expertise in various areas such as investment strategies, tax planning, retirement savings options, and debt management—allowing them to offer personalized recommendations based on clients’ unique situations. When selecting a financial advisor, it is essential to consider factors such as credentials (e.g., Certified Financial Planner designation), experience level within specific areas relevant to one’s needs (e.g., real estate investing), and fee structures (e.g., hourly rates versus commission-based).

A good advisor will take the time to understand clients’ financial aspirations while providing actionable steps toward achieving those goals effectively. By leveraging professional expertise alongside personal commitment toward saving and investing wisely over time—individuals can build a solid foundation for long-term financial success.

If you’re looking to build a fund for your home purchase, it’s essential to have a solid plan in place. A great resource to help you get started is the article on how to build a home buying fund available at How Wealth Grows. This article provides valuable insights and practical tips on saving effectively, budgeting, and investing wisely to reach your homeownership goals.

FAQs

What is a home buying fund?

A home buying fund is a dedicated savings account or financial reserve specifically set aside to cover the costs associated with purchasing a home, including the down payment, closing costs, and other related expenses.

Why is it important to build a home buying fund?

Building a home buying fund helps ensure you have enough money to cover upfront costs, reduces the need for high-interest loans, improves your chances of mortgage approval, and provides financial security during the home buying process.

How much should I save for a home buying fund?

The amount varies depending on the home price and location, but a common recommendation is to save at least 20% of the home’s purchase price for a down payment, plus additional funds for closing costs (typically 2-5% of the purchase price) and moving expenses.

What are effective strategies to build a home buying fund?

Effective strategies include setting a clear savings goal, creating a budget, automating regular transfers to a dedicated savings account, reducing discretionary spending, and considering additional income sources such as side jobs or bonuses.

Where should I keep my home buying fund?

It is advisable to keep your home buying fund in a safe, easily accessible, and interest-bearing account such as a high-yield savings account or a money market account to preserve capital and earn some interest.

Can I use retirement savings for a home buying fund?

While it is possible to use certain retirement accounts like a 401(k) or IRA for a home purchase, it is generally not recommended due to potential taxes, penalties, and the impact on long-term retirement savings. Consult a financial advisor before making such decisions.

How long does it typically take to build a home buying fund?

The time required depends on your savings rate, income, and home price goals. It can range from several months to several years. Consistent saving and disciplined budgeting can help shorten this timeline.

Are there any government programs to assist with building a home buying fund?

Yes, some government programs offer down payment assistance, grants, or tax benefits to first-time homebuyers. Availability varies by location, so researching local and federal programs is recommended.

What expenses should I consider when building a home buying fund besides the down payment?

Besides the down payment, consider closing costs, home inspection fees, moving expenses, initial home repairs or improvements, property taxes, homeowners insurance, and emergency reserves for unexpected costs.

How can I stay motivated while saving for a home buying fund?

Setting clear goals, tracking progress, celebrating milestones, visualizing homeownership benefits, and maintaining a disciplined savings plan can help maintain motivation throughout the saving process.