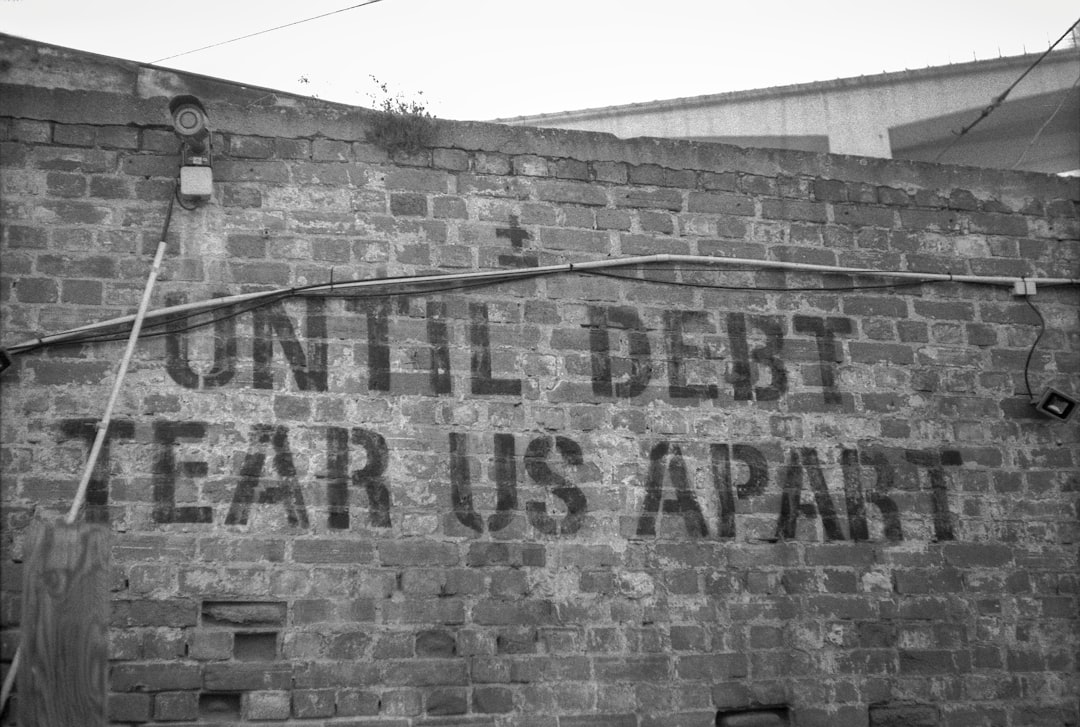

Understanding the Education Debt Trap

The education debt trap represents a significant financial challenge for students pursuing higher education. This cycle occurs when individuals accumulate substantial student loans that can lead to long-term financial constraints. Many students, motivated by educational aspirations, may not fully consider the financial implications of taking on significant debt.

The promise of higher education can sometimes obscure the practical realities of loan repayment, potentially resulting in financial obligations that may require many years to resolve. This issue extends beyond individual circumstances and indicates structural problems within educational financing systems. With the continuous increase in tuition costs, students increasingly depend on loans to fund their education.

This dependency can create a problematic cycle where educational debt subsequently limits financial freedom after graduation. Recognizing the nature of this trap is essential for making well-informed educational and financial decisions.

Key Takeaways

- Education debt arises from high tuition costs and insufficient financial planning.

- Student debt significantly affects graduates’ financial stability and mental health.

- Avoiding debt involves budgeting, choosing affordable schools, and seeking scholarships.

- Alternative financing options include grants, work-study programs, and income-share agreements.

- Effective debt management requires informed loan decisions, repayment plans, and utilizing support resources.

Identifying the Causes of Education Debt

To effectively navigate the education debt landscape, you must first identify its root causes. One significant factor is the skyrocketing cost of tuition and associated fees. Over the past few decades, college expenses have outpaced inflation, making it increasingly difficult for students to afford higher education without incurring debt.

As you consider your options, it’s essential to recognize how these rising costs can impact your financial future. Another contributing factor is the lack of financial literacy among students. Many individuals enter college without a clear understanding of how loans work or the long-term implications of borrowing.

This lack of knowledge can lead to poor decision-making when it comes to financing your education. By educating yourself about interest rates, repayment terms, and the overall loan process, you can better prepare yourself to make sound financial choices that will serve you well in the long run.

The Impact of Education Debt on Students

The impact of education debt on students is profound and multifaceted. For many, the burden of student loans can lead to significant stress and anxiety. You may find yourself constantly worrying about how you will manage your monthly payments while also trying to build a career and establish financial stability.

This stress can affect not only your academic performance but also your overall well-being. Moreover, education debt can limit your career choices and opportunities. With a significant portion of your income going toward loan repayment, you may feel compelled to take higher-paying jobs that don’t align with your passions or interests.

This pressure can stifle your creativity and hinder your ability to pursue fulfilling work. Understanding these impacts is vital as you navigate your educational path and consider the long-term implications of your financial decisions.

Strategies for Avoiding Education Debt

To avoid falling into the education debt trap, it’s essential to adopt proactive strategies before and during your college experience.

By tracking your spending and identifying areas where you can cut costs, you can minimize the amount you need to borrow.

Consider living at home or choosing a more affordable institution to reduce tuition and housing expenses. Additionally, seeking part-time employment while studying can help alleviate some financial pressure. Many students find that working even a few hours a week allows them to cover essential costs without relying solely on loans.

Balancing work and study may be challenging, but it can provide valuable experience and help you develop time management skills that will benefit you in the future.

Exploring Alternative Education Financing Options

| Metric | Description | Typical Value / Range | Impact on Borrowers |

|---|---|---|---|

| Average Student Loan Debt | The average amount of debt accumulated by a student upon graduation | 20,000 – 40,000 | High debt can delay financial independence and major life decisions |

| Interest Rate | Annual percentage rate charged on student loans | 3% – 7% | Higher rates increase total repayment amount and lengthen payoff time |

| Repayment Period | Typical duration to repay student loans | 10 – 30 years | Longer periods can lead to more interest paid and prolonged financial burden |

| Default Rate | Percentage of borrowers who fail to repay loans | 10% – 15% | Default negatively impacts credit score and financial opportunities |

| Monthly Payment | Average monthly amount paid towards student loans | 200 – 500 | High payments reduce disposable income and savings potential |

| Income-Driven Repayment Plans | Repayment options based on borrower’s income | 10% – 20% of discretionary income | Can reduce monthly payments but may increase total interest paid |

| Loan Forgiveness Programs | Programs that cancel remaining debt after certain conditions | 5 – 20 years of qualifying payments | Can relieve debt burden but eligibility is limited |

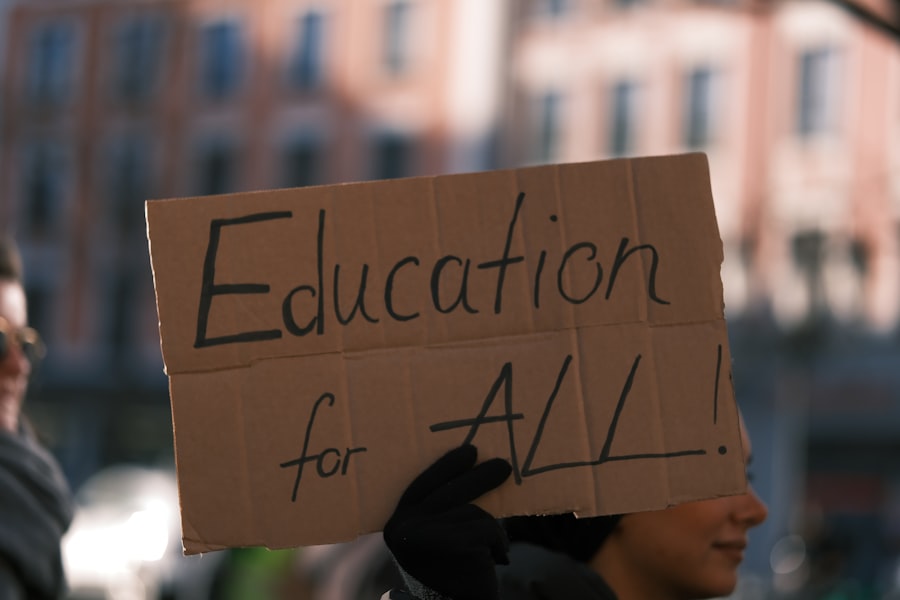

While student loans are often the go-to option for financing education, there are alternative methods worth exploring. Scholarships and grants are excellent resources that do not require repayment, making them ideal for reducing your overall financial burden. Researching available scholarships based on merit, need, or specific criteria related to your field of study can yield significant financial support.

Another alternative is income-share agreements (ISAs), which allow you to receive funding for your education in exchange for a percentage of your future income for a set period. This model aligns the interests of both parties, as you only repay when you’re earning a stable income. Exploring these options can provide you with a more sustainable approach to financing your education without falling into crippling debt.

Managing Education Debt After Graduation

Once you graduate, managing education debt becomes a top priority. The transition from student life to professional life can be overwhelming, especially when faced with loan repayment obligations. It’s essential to develop a clear plan for managing your debt effectively.

Start by reviewing all your loans, including their interest rates and repayment terms, so you have a comprehensive understanding of what you owe. Creating a budget that incorporates your loan payments is crucial for maintaining financial stability post-graduation. You may need to adjust your spending habits and prioritize essential expenses while allocating funds toward loan repayment.

Additionally, consider exploring options such as income-driven repayment plans or loan consolidation if you find yourself struggling to meet monthly payments.

Seeking Financial Aid and Scholarships

As you navigate the complexities of financing your education, actively seeking financial aid and scholarships can significantly ease your burden. Many institutions offer various forms of assistance based on academic performance, financial need, or specific talents and interests.

Don’t hesitate to reach out to your school’s financial aid office for guidance on available resources. They can provide valuable information about local scholarships, federal aid programs, and other funding opportunities that may be available to you. By being proactive in seeking financial assistance, you can reduce the amount you need to borrow and set yourself up for a more secure financial future.

Understanding the True Cost of Education

Understanding the true cost of education goes beyond just tuition fees; it encompasses various factors that contribute to your overall expenses while in school. You should consider costs such as textbooks, supplies, housing, transportation, and even personal expenses when calculating how much money you will need. By taking a holistic view of these costs, you can better prepare yourself financially.

Additionally, it’s essential to factor in potential lost income during your time in school if you choose to study full-time instead of working. This consideration will help you gauge the total investment required for your education and allow you to make informed decisions about how much debt is reasonable for you to take on.

Making Informed Decisions About Student Loans

When it comes time to take out student loans, making informed decisions is paramount. Start by comparing different loan options available to you, including federal versus private loans. Federal loans often come with more favorable terms, such as lower interest rates and flexible repayment options, making them a preferable choice for many students.

Before signing any loan agreement, carefully read through the terms and conditions. Pay attention to interest rates, repayment schedules, and any potential fees associated with borrowing. By understanding these details upfront, you can avoid unpleasant surprises down the line and ensure that you are making choices that align with your long-term financial goals.

Creating a Repayment Plan for Education Debt

Creating a repayment plan for your education debt is essential for maintaining control over your finances after graduation. Start by determining how much you can realistically afford to pay each month based on your income and other expenses. This assessment will help you establish a timeline for paying off your loans while ensuring that you can still meet your other financial obligations.

Consider setting up automatic payments or reminders to help you stay on track with your repayment schedule. Additionally, explore options for making extra payments when possible; even small additional contributions can significantly reduce the total interest paid over time and shorten the life of your loan.

Seeking Support and Resources for Managing Education Debt

Finally, don’t hesitate to seek support and resources for managing education debt effectively. Many organizations offer financial counseling services specifically designed for graduates navigating student loans. These resources can provide valuable insights into budgeting strategies, repayment options, and ways to improve your overall financial literacy.

Connecting with peers who are also managing their student debt can be beneficial as well. Sharing experiences and strategies can provide encouragement and practical tips for tackling this common challenge together. Remember that seeking help is not a sign of weakness; rather, it demonstrates your commitment to taking control of your financial future.

In conclusion, navigating the complexities of education debt requires careful consideration and proactive planning at every stage of your educational journey. By understanding the causes and impacts of student loans, exploring alternative financing options, and developing effective management strategies post-graduation, you can set yourself up for success while minimizing the burden of debt on your life.

The education debt trap is a pressing issue for many students today, as they often find themselves burdened with loans that can take years, if not decades, to repay. For a deeper understanding of the financial implications and potential solutions to this problem, you can read the article on this topic at How Wealth Grows. This resource provides valuable insights into managing education debt and exploring alternative pathways to financial stability.

📌WATCH THIS! They Sold Your School Building—Then Made You Rent It Back

FAQs

What is an education debt trap?

An education debt trap occurs when students accumulate large amounts of student loan debt that becomes difficult to repay, often due to high interest rates, low post-graduation income, or extended repayment periods.

How does student loan debt become a trap?

Student loan debt becomes a trap when borrowers are unable to keep up with payments, leading to increased interest, penalties, and a cycle of debt that limits financial freedom and opportunities.

What factors contribute to the education debt trap?

Contributing factors include rising tuition costs, insufficient financial aid, low starting salaries after graduation, lack of financial literacy, and high-interest rates on student loans.

Who is most affected by the education debt trap?

Typically, low- and middle-income students, first-generation college students, and those pursuing degrees in lower-paying fields are most vulnerable to falling into the education debt trap.

What are the consequences of being in an education debt trap?

Consequences can include delayed homeownership, difficulty saving for retirement, increased stress and mental health issues, limited career choices, and potential damage to credit scores.

Can education debt be forgiven or discharged?

In some cases, student loans can be forgiven or discharged through specific programs such as Public Service Loan Forgiveness, income-driven repayment plans, or in cases of total and permanent disability, but eligibility criteria apply.

How can students avoid falling into the education debt trap?

Students can avoid the trap by researching affordable education options, applying for scholarships and grants, borrowing only what is necessary, understanding loan terms, and planning for repayment before borrowing.

What role do interest rates play in the education debt trap?

Higher interest rates increase the total amount owed over time, making it harder to pay off the principal balance and potentially trapping borrowers in long-term debt.

Are there alternatives to taking on student loan debt?

Yes, alternatives include attending community colleges, working part-time while studying, seeking employer tuition assistance, applying for scholarships, and choosing less expensive educational programs.

What resources are available to help manage or reduce education debt?

Resources include financial counseling services, income-driven repayment plans, loan consolidation options, government forgiveness programs, and nonprofit organizations that provide debt management assistance.