Inflation is a term that often surfaces in discussions about the economy, yet its implications can be complex and multifaceted. At its core, inflation refers to the general increase in prices of goods and services over time, which leads to a decrease in the purchasing power of money. You may have noticed that what you could buy for a dollar a decade ago is no longer the same today.

This phenomenon is not merely an economic statistic; it has real-world consequences that affect your daily life, from the groceries you buy to the savings you accumulate for future needs. Understanding inflation is crucial for anyone looking to manage their finances effectively.

As you navigate your financial landscape, recognizing how inflation operates and its potential impact on your financial health will empower you to make informed decisions. In this article, we will explore various aspects of inflation, including its effects on purchasing power, everyday expenses, savings, and investments, as well as strategies to mitigate its impact.

Key Takeaways

- Inflation is the rate at which the general level of prices for goods and services is rising, leading to a decrease in purchasing power.

- Inflation erodes the purchasing power of money, meaning that the same amount of money buys fewer goods and services over time.

- Everyday expenses such as groceries, utilities, and transportation can become more costly due to inflation, impacting household budgets.

- Savings and investments can lose value in real terms due to inflation, making it important to consider inflation when planning for the future.

- Strategies such as investing in assets that typically outpace inflation, like stocks or real estate, can help protect finances against the effects of inflation.

Understanding the Impact of Inflation on Purchasing Power

When inflation rises, the value of your money diminishes, which directly affects your purchasing power. This means that the same amount of money buys fewer goods and services than it did previously. For instance, if you have $100 today and inflation is at 3%, in a year, that $100 will only have the purchasing power equivalent to about $97.

This gradual erosion of value can significantly impact your ability to maintain your standard of living over time. You may find that your monthly budget stretches less far as prices increase. Essentials like food, housing, and transportation can become more expensive, forcing you to make difficult choices about where to allocate your resources.

Understanding this relationship between inflation and purchasing power is vital for effective financial planning. By keeping an eye on inflation rates and adjusting your budget accordingly, you can better prepare for the financial challenges that may arise.

The Hidden Costs of Inflation on Everyday Expenses

Inflation often manifests in subtle ways that can catch you off guard. While you may be aware of rising prices at the grocery store or gas station, other costs can increase without you even realizing it. For example, subscription services, utility bills, and even healthcare costs can rise gradually over time due to inflationary pressures.

These hidden costs can accumulate, leading to a significant impact on your overall financial situation.

You might find that a small increase in your monthly bills can add up over the course of a year or more.

By tracking your spending and being aware of how inflation affects various aspects of your life, you can make more informed decisions about where to cut back or adjust your budget. This proactive approach will help you mitigate the hidden costs of inflation and maintain better control over your finances.

How Inflation Affects Savings and Investments

| Aspect | Impact |

|---|---|

| Savings | Decreases in real value over time due to inflation |

| Investments | May provide lower returns than inflation rate, leading to loss of purchasing power |

| Interest Rates | May not keep up with inflation, reducing the growth of savings and investments |

| Asset Prices | May increase to keep pace with inflation, affecting investment decisions |

Inflation doesn’t just impact your immediate purchasing power; it also has long-term implications for your savings and investments. If you keep your money in a traditional savings account with a low-interest rate, inflation can erode the value of those savings over time. For instance, if your savings account earns 1% interest while inflation is at 3%, you are effectively losing money in real terms.

This scenario highlights the importance of seeking investment options that outpace inflation. Investing in assets that historically provide returns above the rate of inflation can be a wise strategy for preserving and growing your wealth. Stocks, real estate, and commodities are examples of investments that have the potential to yield higher returns over time.

However, it’s crucial to assess your risk tolerance and investment goals before diving into these markets. By understanding how inflation affects different types of investments, you can make more strategic choices that align with your financial objectives.

Strategies for Protecting Your Finances Against Inflation

To safeguard your finances against the adverse effects of inflation, consider implementing several strategies that can help preserve your purchasing power. One effective approach is diversifying your investment portfolio. By spreading your investments across various asset classes—such as stocks, bonds, real estate, and commodities—you can reduce risk while increasing the likelihood of achieving returns that outpace inflation.

Another strategy involves regularly reviewing and adjusting your budget to account for rising costs. This may mean cutting back on discretionary spending or finding ways to increase your income through side hustles or additional work opportunities. Additionally, consider investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), which are designed to provide returns that keep pace with inflation.

By taking these proactive steps, you can better position yourself to weather the financial challenges posed by inflation.

The Role of Central Banks in Managing Inflation

Central banks play a pivotal role in managing inflation within an economy. They utilize various monetary policy tools to influence interest rates and control money supply, which in turn affects inflation rates. When inflation rises above target levels, central banks may increase interest rates to cool down economic activity and curb spending.

Conversely, during periods of low inflation or deflation, they may lower interest rates to stimulate borrowing and spending. As an individual navigating the financial landscape, it’s essential to stay informed about central bank policies and their potential impact on the economy. Changes in interest rates can affect everything from mortgage rates to credit card interest rates, influencing your borrowing costs and overall financial health.

By understanding how central banks operate and their role in managing inflation, you can make more informed decisions regarding your finances.

Historical Examples of Inflation’s Impact on Economies

Throughout history, various economies have experienced significant inflationary periods that have left lasting impacts on their financial landscapes. One notable example is Germany’s hyperinflation in the early 1920s, where prices skyrocketed so dramatically that people were using wheelbarrows full of cash just to buy basic goods. This catastrophic event serves as a stark reminder of how unchecked inflation can devastate an economy and erode public trust in currency.

Another example is Zimbabwe’s hyperinflation in the late 2000s, where inflation rates reached astronomical levels, rendering the national currency nearly worthless. These historical instances illustrate not only the dangers of high inflation but also the importance of sound monetary policy and fiscal responsibility in maintaining economic stability. By studying these examples, you can gain valuable insights into how inflation can shape economies and influence financial decision-making.

Inflation’s Influence on Interest Rates and Borrowing

Inflation has a direct correlation with interest rates, which can significantly impact your borrowing costs. When inflation rises, central banks often respond by increasing interest rates to combat rising prices. This means that loans—whether for a home mortgage or personal credit—can become more expensive as interest rates climb.

As a borrower, higher interest rates can lead to increased monthly payments and overall borrowing costs. Conversely, during periods of low inflation or deflation, central banks may lower interest rates to encourage borrowing and stimulate economic growth. For you as a consumer or investor, understanding this relationship between inflation and interest rates is crucial for making informed decisions about loans and investments.

By keeping an eye on economic indicators and central bank policies, you can better anticipate changes in borrowing costs and adjust your financial strategies accordingly.

The Global Impact of Inflation on Trade and Exchange Rates

Inflation does not exist in a vacuum; it has far-reaching implications for global trade and exchange rates as well. When one country experiences high inflation relative to others, its currency may depreciate against foreign currencies. This depreciation can make imports more expensive while making exports cheaper for foreign buyers.

As a result, countries with lower inflation rates may find themselves at a competitive advantage in international trade. For you as a consumer or investor, fluctuations in exchange rates due to inflation can affect everything from travel costs to investment returns in foreign markets. If you’re planning a trip abroad or investing in international stocks or bonds, understanding how inflation impacts exchange rates will help you make more informed decisions about currency conversion and investment strategies.

Inflation’s Effect on Wage Growth and Income Disparities

Inflation also plays a significant role in wage growth and income disparities within an economy. While wages may rise over time due to increased demand for labor or cost-of-living adjustments, they often do not keep pace with rising prices caused by inflation. This discrepancy can lead to a decline in real wages for many workers, exacerbating income inequality as those with fixed incomes or lower-paying jobs struggle to maintain their standard of living.

As you consider your own financial situation, it’s essential to recognize how inflation affects wage growth in your industry or profession. Negotiating salary increases or seeking additional training and education may be necessary steps to ensure that your income keeps pace with rising costs. By being proactive about your career development and understanding the broader economic context of wage growth, you can better position yourself for financial success despite the challenges posed by inflation.

Navigating the Hidden Tax of Inflation in Your Financial Planning

In conclusion, navigating the complexities of inflation is essential for effective financial planning. As you’ve learned throughout this article, inflation impacts various aspects of your financial life—from purchasing power and everyday expenses to savings and investments. By understanding these dynamics and implementing strategies to protect yourself against rising prices, you can better safeguard your financial future.

Staying informed about economic trends, central bank policies, and historical examples of inflation will empower you to make sound financial decisions. Whether it’s diversifying your investments or adjusting your budget to account for rising costs, being proactive will help you navigate the hidden tax of inflation effectively. Ultimately, by taking control of your finances in an inflationary environment, you can work towards achieving greater financial stability and security for yourself and your family.

In exploring the concept of hidden taxes, it’s essential to understand how they can subtly impact personal wealth and financial growth. Hidden taxes often manifest in the form of inflation, regulatory fees, or indirect levies that aren’t immediately apparent to the average consumer. For a deeper dive into how these hidden costs can affect your financial well-being and strategies to mitigate their impact, you might find this article on How Wealth Grows particularly insightful. It provides a comprehensive overview of wealth accumulation and the various factors that can influence it, including those less obvious financial burdens.

💸WATCH THIS! The Hidden Tax That Makes Everything You Buy a Scam

FAQs

What is the hidden tax?

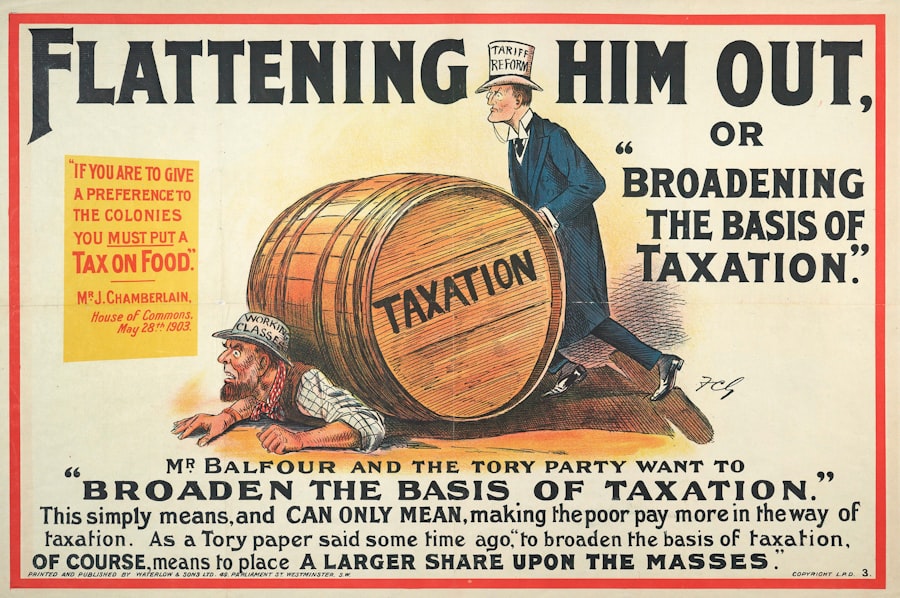

The hidden tax refers to the additional costs that consumers may incur due to factors such as inflation, government regulations, or corporate practices. These costs are not explicitly stated but are passed on to consumers in the form of higher prices for goods and services.

How does the hidden tax affect consumers?

The hidden tax can impact consumers by reducing their purchasing power and increasing the overall cost of living. It can also lead to inequality as lower-income individuals may bear a disproportionate burden of these hidden costs.

What are some examples of the hidden tax?

Examples of the hidden tax include increased prices due to tariffs or trade restrictions, higher costs resulting from government regulations, and fees or surcharges imposed by businesses that are passed on to consumers.

How can consumers mitigate the impact of the hidden tax?

Consumers can mitigate the impact of the hidden tax by staying informed about economic and regulatory changes, comparing prices and seeking out more affordable options, and advocating for policies that promote transparency and fairness in pricing.