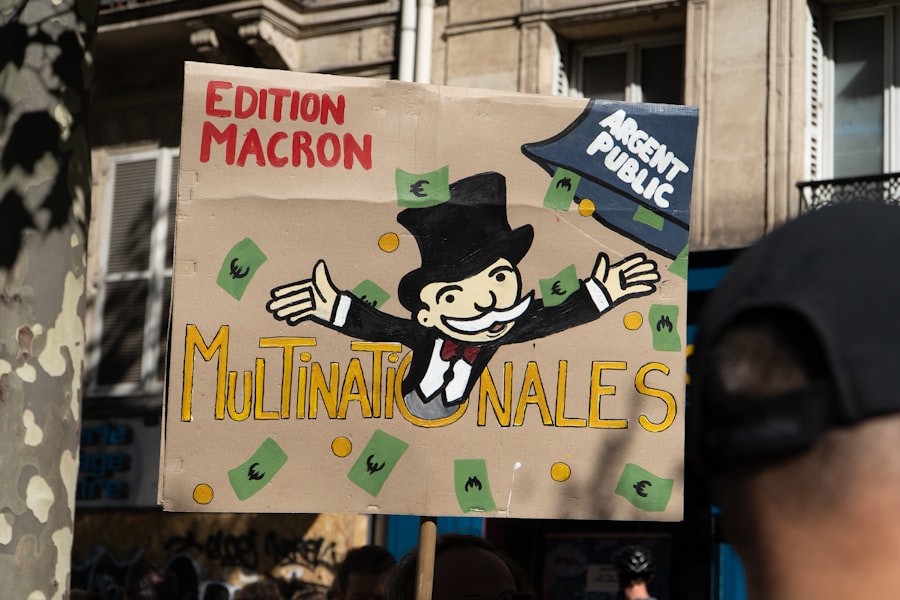

In recent years, the term “corporate greedflation” has emerged as a focal point of discussion among economists, policymakers, and the general public. This phenomenon refers to the intersection of corporate greed and inflation, where companies exploit economic conditions to maximize profits at the expense of consumers and employees. As inflation rates rise, many corporations have seized the opportunity to increase prices beyond what is necessary to cover rising costs, often citing supply chain disruptions or increased labor expenses as justifications.

This practice not only burdens consumers but also raises questions about the ethical responsibilities of corporations in a capitalist society. The implications of corporate greedflation extend far beyond mere price increases. It reflects a broader trend in which profit motives overshadow the welfare of individuals and communities.

As corporations prioritize shareholder value over social responsibility, the gap between corporate profits and the average consumer’s purchasing power widens. This article aims to explore the historical context of corporate greed, its impact on various stakeholders, and potential strategies for addressing this pressing issue.

Key Takeaways

- Corporate Greedflation is a growing concern that impacts consumers, employees, small businesses, and income inequality.

- The history of corporate greed and inflation highlights the need for government regulation and ethical considerations.

- Consumers are negatively impacted by corporate greedflation through higher prices and reduced quality of goods and services.

- Government regulation is essential in addressing corporate greedflation and protecting consumers and employees.

- Corporate greed has a direct impact on employee wages and benefits, contributing to income inequality and ethical concerns.

The History of Corporate Greed and Inflation

The roots of corporate greed can be traced back to the early days of capitalism, where the pursuit of profit often led to exploitative practices. Throughout history, there have been numerous instances where corporations prioritized their financial gain over ethical considerations. The Industrial Revolution marked a significant turning point, as factories emerged and labor conditions deteriorated.

Workers faced long hours, low wages, and unsafe environments while corporations reaped substantial profits. This historical backdrop set the stage for a culture of greed that persists today. Inflation, on the other hand, has been a recurring theme in economic cycles.

The post-World War II era saw significant inflationary pressures due to increased consumer demand and government spending. However, it was during the 1970s that inflation reached alarming levels, leading to what is now referred to as “stagflation.” In this context, corporations began to adopt strategies that allowed them to pass on costs to consumers while maintaining profit margins. The interplay between corporate greed and inflation has evolved over decades, with each economic crisis revealing the lengths to which companies will go to protect their interests.

The Impact of Corporate Greedflation on Consumers

The consequences of corporate greedflation are acutely felt by consumers, who find themselves grappling with rising prices for essential goods and services. As corporations inflate prices under the guise of increased costs, many consumers are left with diminished purchasing power. This situation is particularly dire for low- and middle-income families, who allocate a larger portion of their budgets to necessities such as food, housing, and healthcare.

The burden of inflated prices can lead to difficult choices, forcing families to cut back on essential items or forgo them altogether. Moreover, corporate greedflation can erode consumer trust in businesses. When companies prioritize profit over transparency and fairness, they risk alienating their customer base.

Consumers are increasingly aware of corporate practices and are more likely to support businesses that demonstrate ethical behavior. As a result, companies that engage in greedflation may face backlash in the form of boycotts or negative publicity, ultimately harming their long-term viability. The relationship between corporations and consumers is complex; when trust is compromised, it can lead to a cycle of discontent that affects both parties.

The Role of Government in Regulating Corporate Greedflation

| Government Role | Regulation | Impact |

|---|---|---|

| Legislation | Enacting laws to limit corporate greedflation | Controls excessive price increases and unethical business practices |

| Enforcement | Monitoring and enforcing compliance with regulations | Prevents companies from taking advantage of consumers |

| Transparency | Requiring companies to disclose financial information | Increases accountability and reduces opportunities for greedflation |

| Consumer Protection | Implementing measures to protect consumer rights | Ensures fair treatment and pricing for consumers |

Governments play a crucial role in regulating corporate behavior and ensuring fair market practices. In the face of corporate greedflation, policymakers must consider implementing measures that protect consumers from exploitative pricing strategies. This could involve stricter regulations on price increases during periods of inflation or enhanced scrutiny of corporate financial practices.

By establishing clear guidelines for pricing transparency and accountability, governments can help mitigate the adverse effects of greedflation on consumers. Additionally, government intervention can extend beyond regulation to include support for small businesses and local economies. By fostering competition and providing resources for smaller enterprises, governments can create an environment where consumers have more choices and are less reliant on large corporations that engage in greedflation.

Ultimately, a balanced approach that combines regulation with support for diverse market players can help curb the negative impacts of corporate greed on society.

Corporate Greed and its Effects on Employee Wages and Benefits

The ramifications of corporate greedflation extend beyond consumers; employees also bear the brunt of these practices. As companies prioritize profit maximization, they often neglect fair compensation for their workforce. In many cases, employees find their wages stagnating or even declining in real terms as inflation erodes their purchasing power.

This trend is particularly concerning in industries where workers are already underpaid or overworked. Moreover, corporate greedflation can lead to cuts in employee benefits as companies seek to maintain profit margins. Health insurance, retirement plans, and other essential benefits may be reduced or eliminated altogether in an effort to appease shareholders.

This not only affects employee morale but also contributes to a broader culture of insecurity within the workforce. When employees feel undervalued and unsupported by their employers, it can lead to decreased productivity and higher turnover rates, ultimately harming the company’s long-term success.

The Ethical and Moral Implications of Corporate Greedflation

The ethical considerations surrounding corporate greedflation are profound and multifaceted. At its core lies a fundamental question about the responsibilities of corporations in society. Should companies prioritize profit above all else, or do they have an obligation to consider the well-being of their employees, consumers, and communities?

Many argue that corporations have a moral duty to act responsibly and ethically, especially in times of economic hardship.

As large corporations continue to amass wealth while many individuals struggle to make ends meet, the disparity between rich and poor becomes increasingly pronounced.

This growing divide can lead to social unrest and disillusionment with the capitalist system itself. Addressing these ethical dilemmas requires a collective effort from businesses, consumers, and policymakers alike to foster a more equitable economic landscape.

Strategies for Combating Corporate Greedflation

To effectively combat corporate greedflation, a multifaceted approach is necessary. One strategy involves increasing consumer awareness about pricing practices and encouraging informed purchasing decisions. By educating consumers about the true costs behind products and services, they can make choices that align with their values and support businesses that prioritize ethical practices.

Another strategy is advocating for stronger labor rights and protections for workers. By empowering employees through collective bargaining and fair wage initiatives, companies may be less inclined to engage in exploitative practices that contribute to greedflation.

The Connection between Corporate Greedflation and Income Inequality

Corporate greedflation is intricately linked to the broader issue of income inequality. As corporations prioritize profits over fair wages and benefits for their employees, the wealth gap continues to widen. This disparity not only affects individual livelihoods but also has far-reaching implications for society as a whole.

When a small percentage of the population controls a disproportionate amount of wealth, it undermines social cohesion and stability. Moreover, income inequality exacerbates other societal issues such as access to education, healthcare, and housing. As individuals struggle to make ends meet due to rising prices driven by corporate greedflation, they may find it increasingly difficult to invest in their futures or contribute positively to their communities.

Addressing income inequality requires a concerted effort from all sectors of society—businesses must recognize their role in perpetuating these disparities and take steps toward more equitable practices.

Corporate Greedflation and its Impact on Small Businesses

Small businesses often find themselves at a disadvantage in an environment characterized by corporate greedflation. While larger corporations may have the resources to absorb rising costs or pass them onto consumers without significant repercussions, small businesses typically operate on thinner margins. As prices rise due to inflationary pressures driven by corporate greed, small businesses may struggle to compete effectively.

Additionally, small businesses often rely on local customers who are directly affected by rising prices. When consumers face financial strain due to corporate greedflation, they may cut back on discretionary spending, impacting small businesses disproportionately. To support these enterprises during challenging economic times, it is essential for communities and governments to prioritize initiatives that promote local shopping and provide resources for small business sustainability.

The Role of Corporate Social Responsibility in Addressing Greedflation

Corporate social responsibility (CSR) has emerged as a vital framework for addressing issues related to corporate greedflation. By adopting CSR practices, companies can demonstrate their commitment to ethical behavior and social accountability. This includes prioritizing fair wages for employees, transparent pricing strategies for consumers, and sustainable practices that benefit communities.

Moreover, CSR initiatives can enhance a company’s reputation and foster consumer loyalty. In an era where consumers are increasingly conscious of corporate behavior, businesses that actively engage in socially responsible practices are more likely to attract customers who value ethics over mere profit maximization. By integrating CSR into their core business strategies, companies can contribute positively to society while mitigating the negative impacts associated with greedflation.

Conclusion and Future Outlook for Corporate Greedflation

As society grapples with the complexities of corporate greedflation, it becomes evident that addressing this issue requires collective action from all stakeholders involved—corporations, consumers, governments, and communities alike. The historical context reveals a persistent pattern of prioritizing profit over ethical considerations; however, there is an opportunity for change through increased awareness and advocacy. Looking ahead, it is crucial for individuals and organizations to remain vigilant in holding corporations accountable for their actions while supporting policies that promote fairness and equity in the marketplace.

By fostering a culture that values ethical behavior over unchecked greed, society can work toward mitigating the adverse effects of corporate greedflation and creating a more just economic landscape for all.

In recent years, the term “greedflation” has emerged as a critical point of discussion in economic circles, referring to the phenomenon where companies inflate prices beyond what is necessary to cover costs, driven by sheer profit motives. This issue has sparked numerous investigations into corporate practices, revealing a pattern of prioritizing shareholder returns over consumer welfare. A related article that delves into the intricacies of this topic can be found on How Wealth Grows. The article provides an in-depth analysis of how corporate strategies contribute to inflationary pressures, impacting everyday consumers. For more insights, you can read the full article here.

WATCH NOW! How Grocery Prices Are a Hidden Corporate Tax 🤑🤑🤑🤑

FAQs

What is corporate greedflation?

Corporate greedflation refers to the practice of companies prioritizing profits and shareholder returns over the well-being of their employees, customers, and the environment. This can manifest in various ways, such as cutting corners on product quality, exploiting workers, or engaging in unethical business practices.

What are some examples of corporate greedflation?

Examples of corporate greedflation include companies engaging in price gouging, exploiting labor in developing countries, engaging in deceptive marketing practices, and prioritizing short-term profits over long-term sustainability.

How does corporate greedflation impact society?

Corporate greedflation can have negative impacts on society, including widening income inequality, environmental degradation, and erosion of consumer trust. It can also lead to social unrest and public backlash against the companies involved.

What can be done to address corporate greedflation?

Addressing corporate greedflation requires a combination of regulatory measures, consumer activism, and corporate responsibility. Governments can enact and enforce laws to hold companies accountable for unethical behavior, while consumers can support ethical businesses and advocate for transparency and accountability. Additionally, companies themselves can adopt ethical business practices and prioritize the well-being of all stakeholders.